Dear reader,

I have been working intensively with pricing for almost 20 years – both as a consultant and in an operational capacity within companies. Pricing has always had an enormous impact: small adjustments, implemented correctly, can lead to great success. But small mistakes can also lead to significant missed opportunities.

There are currently many such opportunities, as markets revolutionized by AI are opening up completely new possibilities for exponential business growth. This applies not only to SaaS providers who are pioneering the integration of AI features into their existing solutions in order to offer their customers even greater added value and, of course, to monetize it. It also applies to developers of purely AI-based agents who are beginning to challenge the established SaaS market leaders.

Those who optimize not only their product but also their pricing will benefit from the growing potential. Unsurprisingly, the results of our survey show that the majority of SaaS experts surveyed plan to revise their pricing in the near future.

Sincerely,

Dr. Sebastian Voigt

Partner & Co-CEO, hy

Dear reader,

Pricing, or more precisely, pricing transparency, has been a constant theme throughout my professional career. After founding Preis.de 20 years ago and later driving market comparison in the consumer sector as Chief Revenue Officer at idealo, I am now fascinated by the question: How can we bring the same transparency to the often opaque world of the B2B software market? With OMR Reviews, we are doing just that – through authentic user reviews, detailed feature information, and insights into pricing.

This study, which we conducted together with our friends at the consultancy hy, takes the next decisive step. We analyzed over 4,000 software profiles to identify the latest trends in SaaS pricing and show which strategies are promising for providers today and in the future.

In a world where artificial intelligence is revolutionizing business models and the classic “per user” approach is reaching its limits, intelligent and fair pricing is becoming a decisive competitive advantage. This study is intended to provide you with inspiration and a reliable basis for making the right decisions in this dynamic environment. I hope you find it insightful!

Sincerely,

Philipp Schrader

Managing Director, OMR Reviews

Meet hy & OMR Reviews

Dr. Sebastian Voigt

Partner & Co-CEO, hy

Nearly 20 years of experience in pricing and commercial excellence (including at Bertelsmann, ProSiebenSat1, Axel Springer), 100+ pricing projects

Charlotte Pohlmann

Principal, hy

Expert in go-to-market and monetization strategies for digital business models, with experience from start-ups and numerous consulting projects

Mariella Knospe

Senior Consultant, hy

Specialist in pricing strategies for digital businesses as well as the development and implementation of new business models

Marvin Müller

VP Marketing, OMR Reviews

Expert in marketing strategy and growth, with experience at Google and in-depth knowledge of performance marketing and search

Huge thank you also to all other contributors: Hendrik Weingarten, Lukas Drömann, Justus Schwarz, Franziska Wagner, Ann-Sophie Teckemeier.

Meet the external Experts

Tom Adebahr

DOCUFY

Philipp Baumanns

telli

Redstone

Moritz Drechsel

4SELLERS

Sophie Genty

compleet

Maurice Gimbel

Gastromatic

Tobias Hagenau

awork

Boy Hengstmann

evasys

Christoph Jost

Flex Capital

Benedikt Kordtomeikel

PMI Advisory

Malte Kosub

Parloa

Caroline Kues

heyData

Tobias Miesel

MOCO

Dr. Oliver Pabst

Redalpine

Hanno Renner

Personio

Jörg Rheinboldt

HEARTFELT_

Sven Ripper

SevDesk

Vivian Seidel

SalesViewer

Nikolai Skatchkov

Circula

Sebastian Stang

Magnolia

Maria Zerhusen

Empion

Christoph Zöller

Instaffo

Meet the hy Experts

Frank Gehrig

Partner, hy

Mariella Knospe

Senior Consultant, hy

Charlotte Pohlmann

Principal, hy

Anne Ringbeck

Vice President, hy

Christoph Röttgen

Senior Vice President, hy

The findings in our report are based on three different sources:

The findings in our report are based on three different sources:

We have analyzed the pricing from over 4,000

OMR Reviews profiles.

We received around 180 responses from SaaS companies in an online survey on AI pricing strategy.

Through discussions with 30 external and internal experts, we were able to gain in-depth insights into SaaS & state-of-the-art AI pricing models.

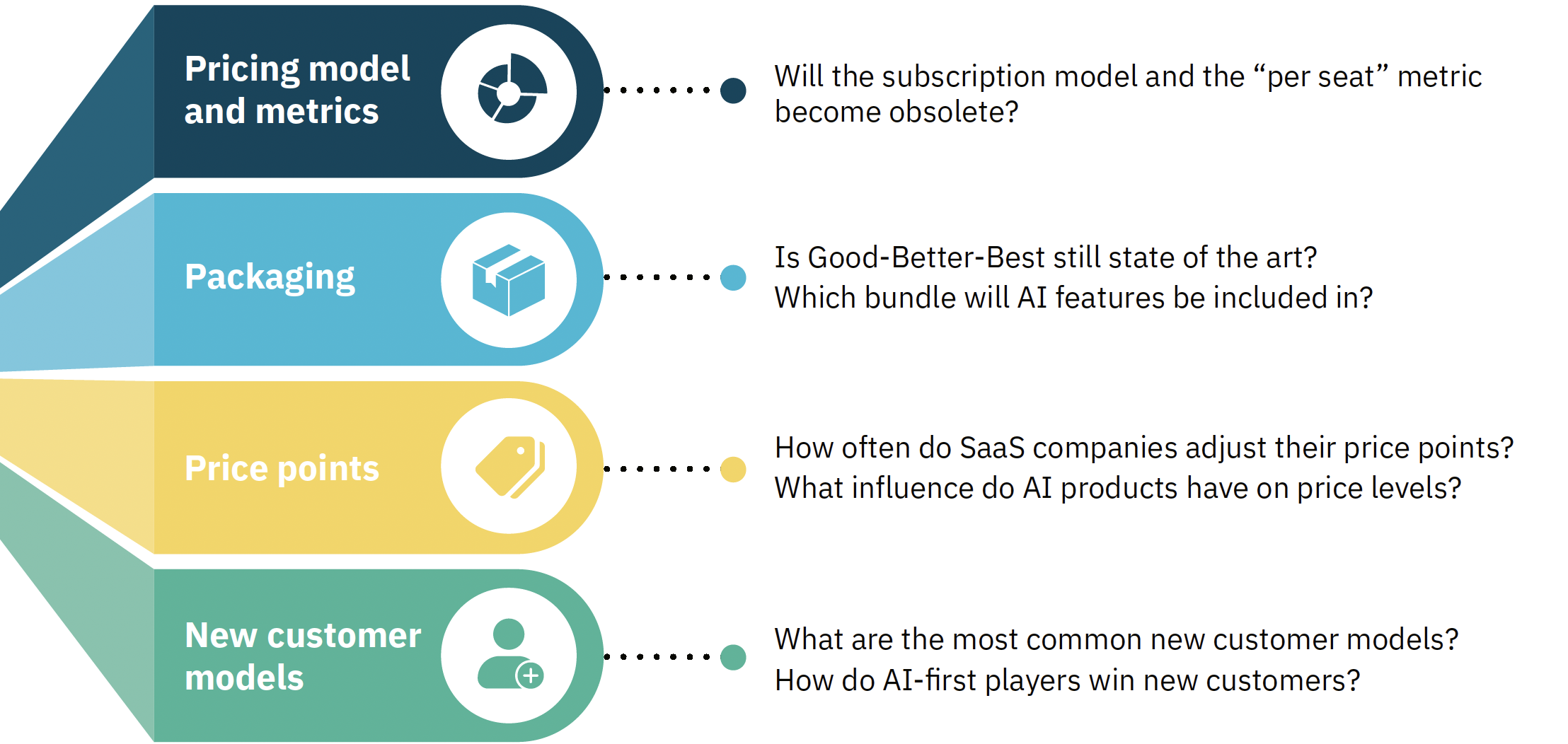

From this, we have derived best practices and trends for SaaS and AI pricing in 2026. Our focus is on four key pricing areas.

No time to read the entire report?

Key findings from this report …

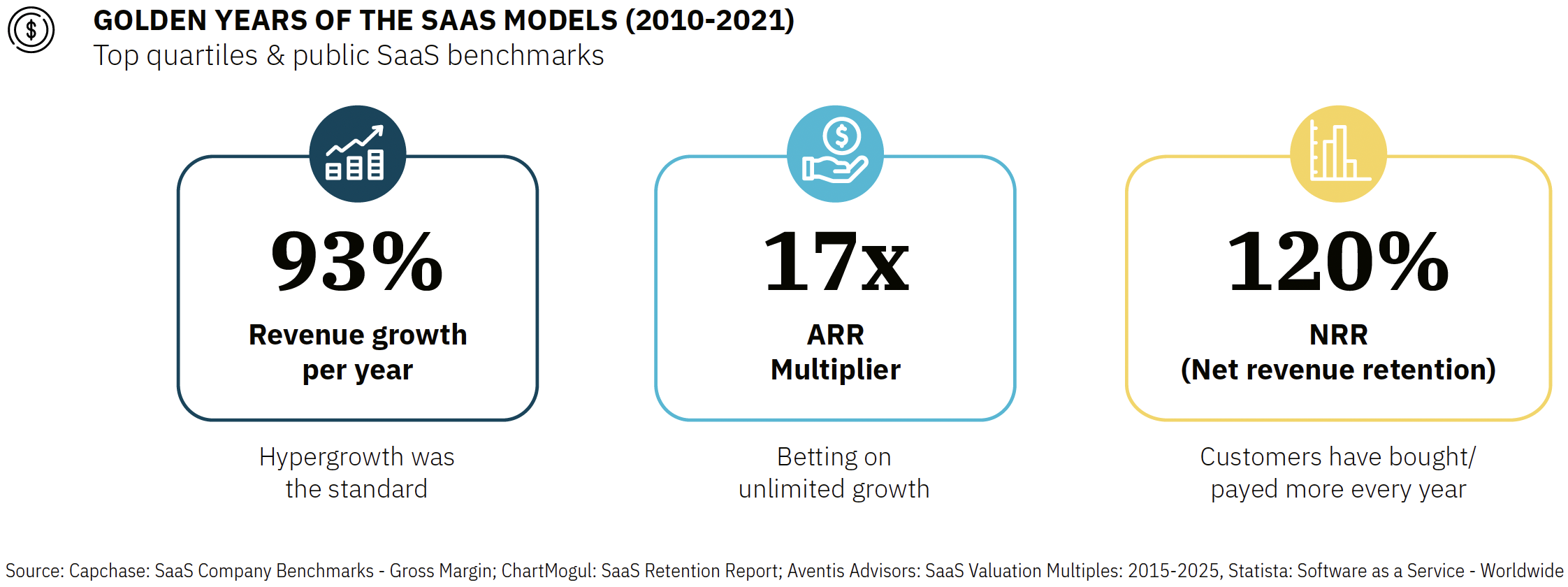

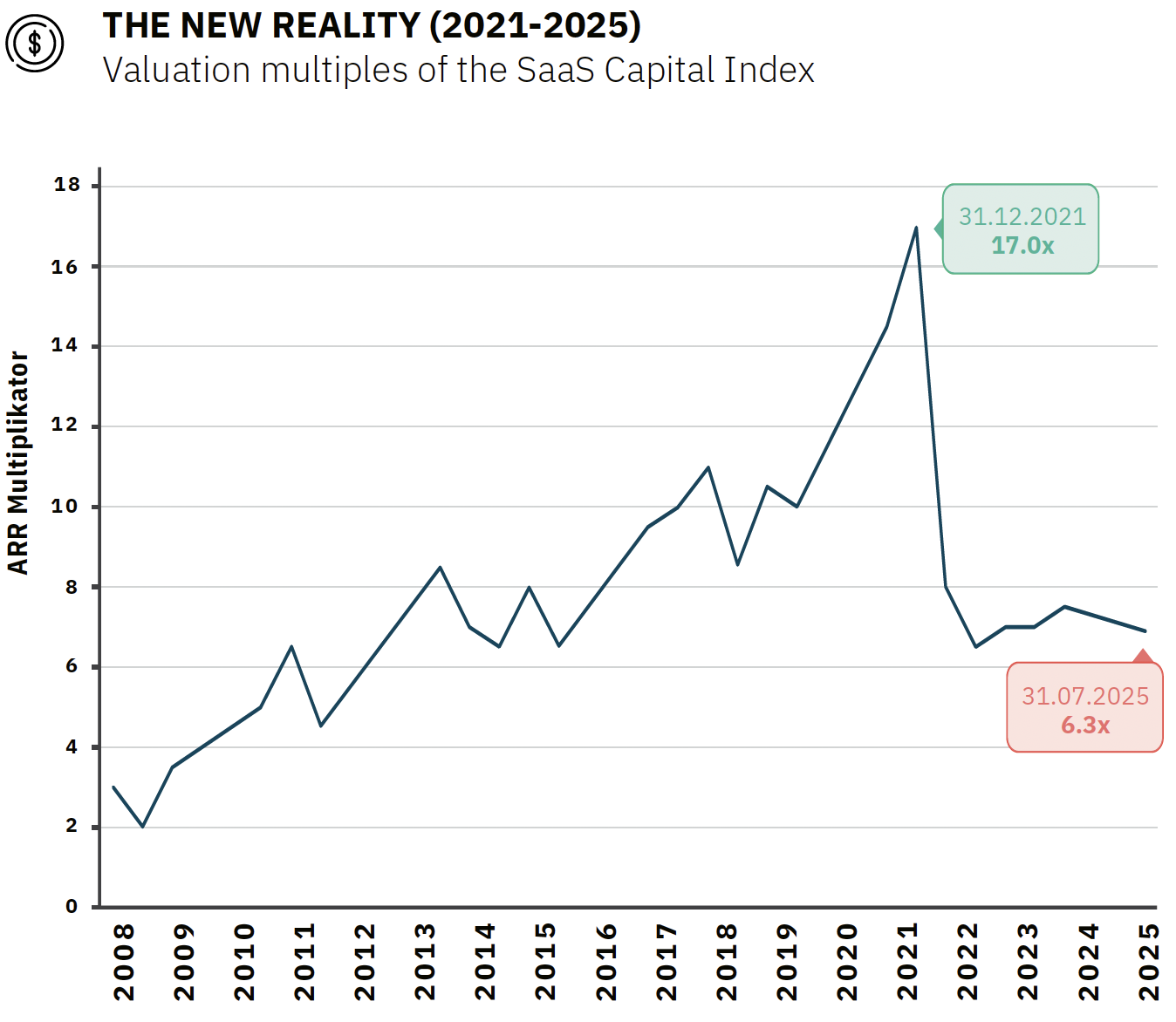

SaaS models are facing structural change

For a long time, SaaS companies were the epitome of a reliable investment case — with continuous growth, scalable user numbers, and attractive recurring revenues

The end of the golden SaaS years: valuation multiples have fallen by 60% since the 2021 peak, forcing adjustments

Quelle: Capchase: SaaS Company Benchmarks – Gross Margin; ChartMogul: SaaS Retention Report; Aventis Advisors: SaaS Valuation Multiples: 2015-2025, Statista: Software as a Service – Worldwide

SaaS valuations have fallen by 60% since their peak, since then they have stabilized at around 7 times the ARR (Source: SaaS Capital Index).

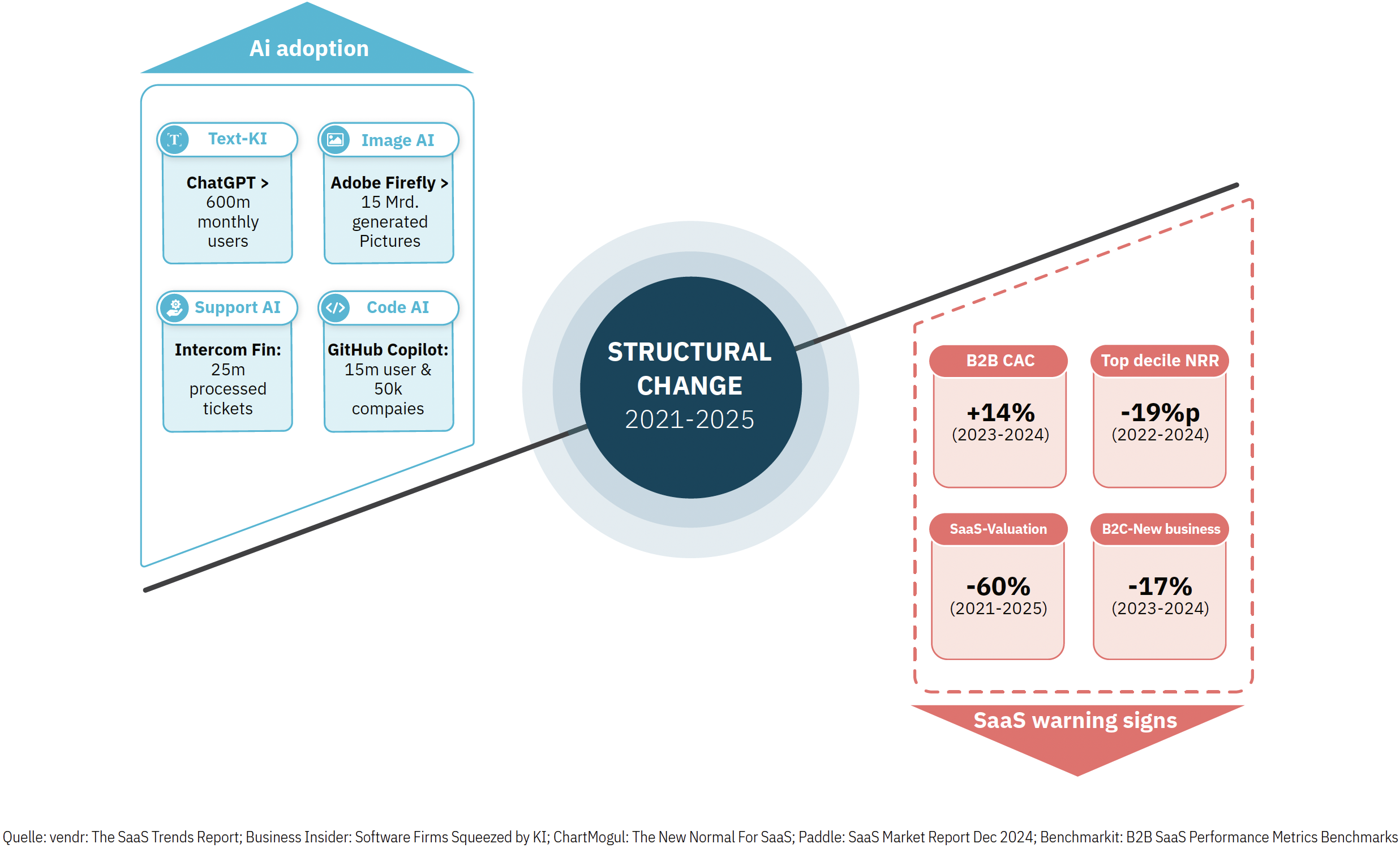

Strategic turning point: The stability of classic SaaS models is faltering, while AI is increasingly being adapted

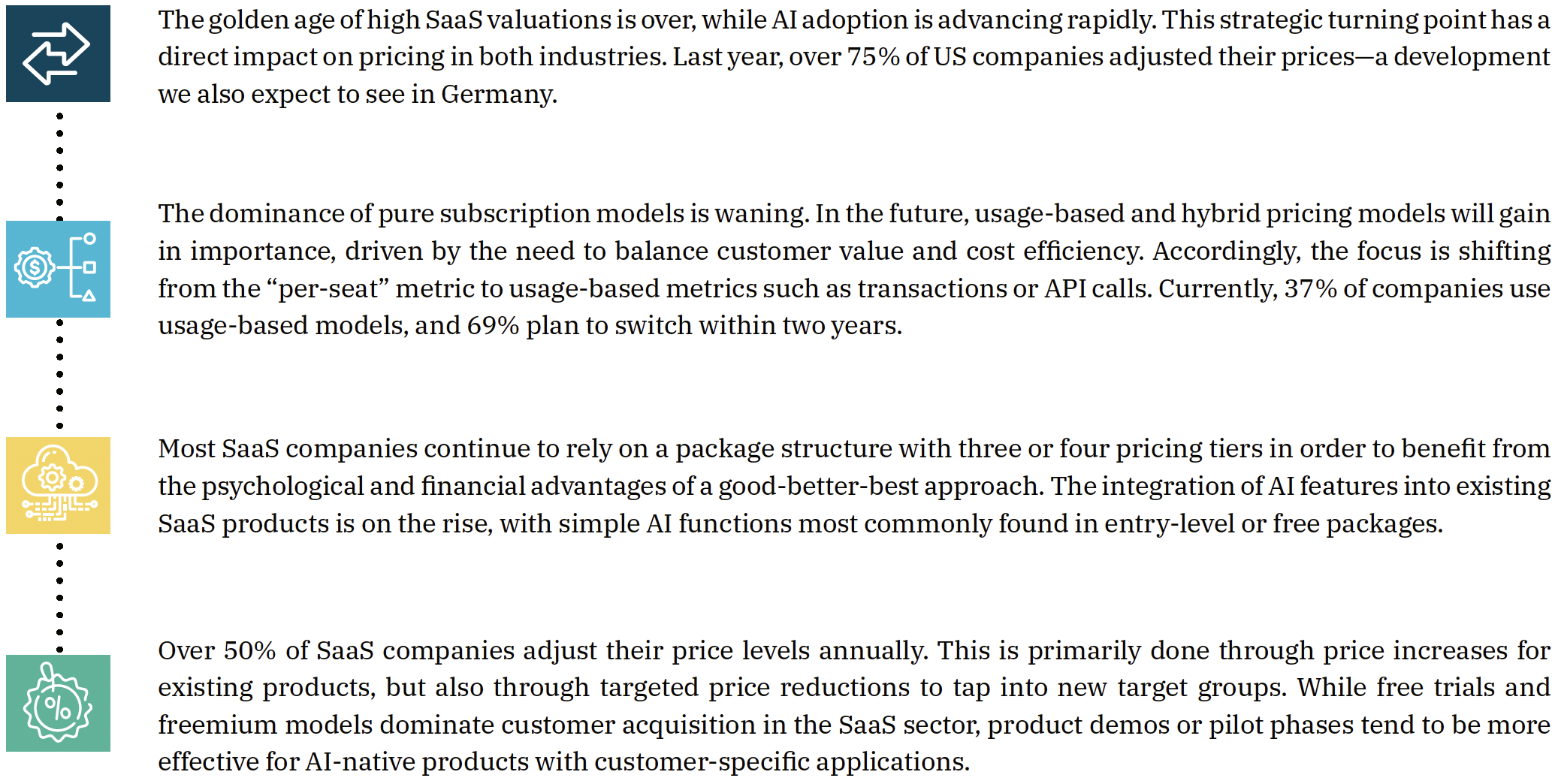

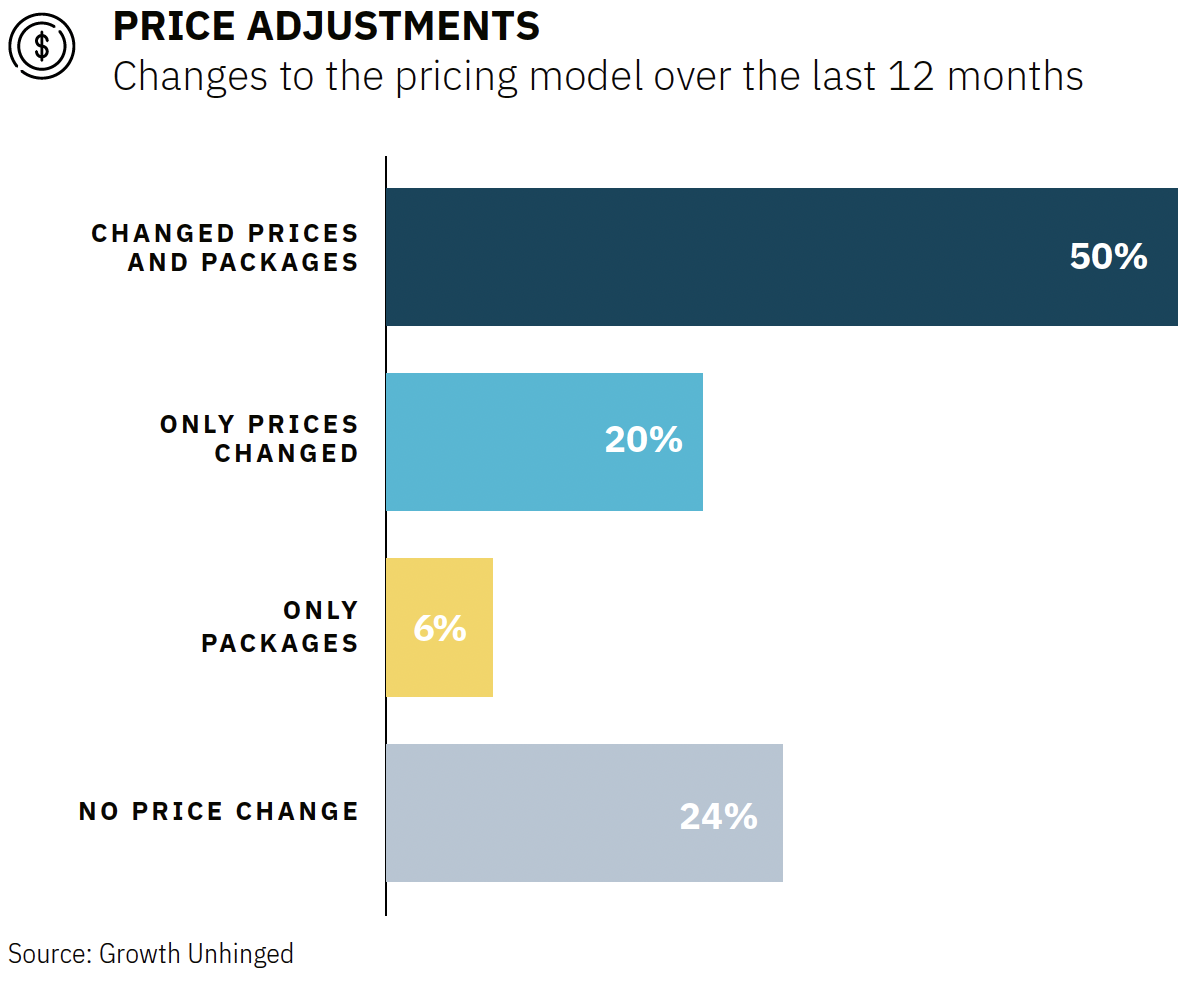

3 out of 4 software companies in the US have changed their pricing in the past year. In Germany, we expect the same trend

Three-quarters of US software companies adjusted their pricing last year. This clearly shows how much the SaaS market is changing under the influence of new technologies. Similar dynamics are also evident in Germany: more than half of the companies surveyed are currently making changes to their pricing structure. 50% are introducing new pricing models, such as usage- or transaction-based approaches that better cater to different customer segments.

A key driver of this development is the use of AI. Only 24% of companies are not currently planning any changes, which impressively confirms the central role of pricing as a control instrument in a technology-driven competitive environment.

Pricing model and metrics

Before we dive in: What is a price model, and what is a price metric?

PRICE MODEL

A price model describes how to charge for something, for example via licenses, subscriptions, usage-based or result-based models. Different price metrics can be combined in order to make the sales logic flexible and customer-oriented.

PRICE METRICS

The price metric describes what is charged, i.e., which unit or reference value the customer pays, e.g., per user, per transaction or per usage unit. It determines the specific basis of assessment for the price within a price model.

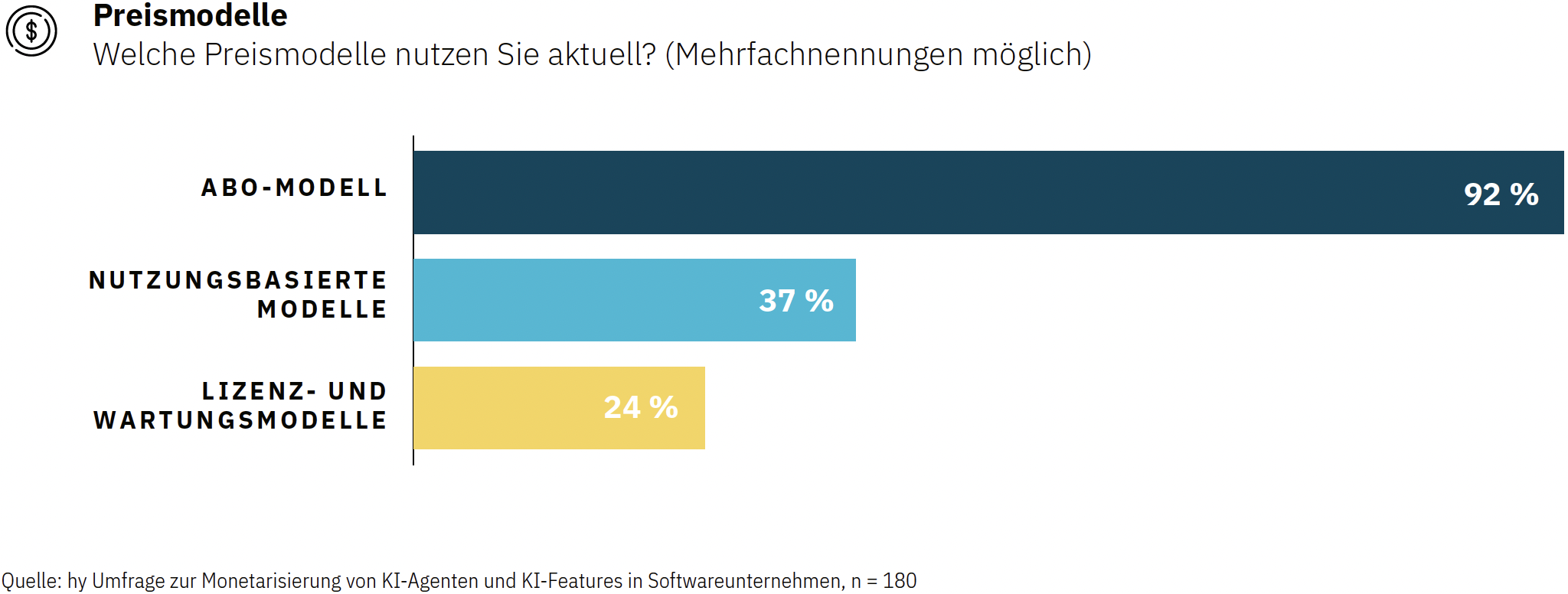

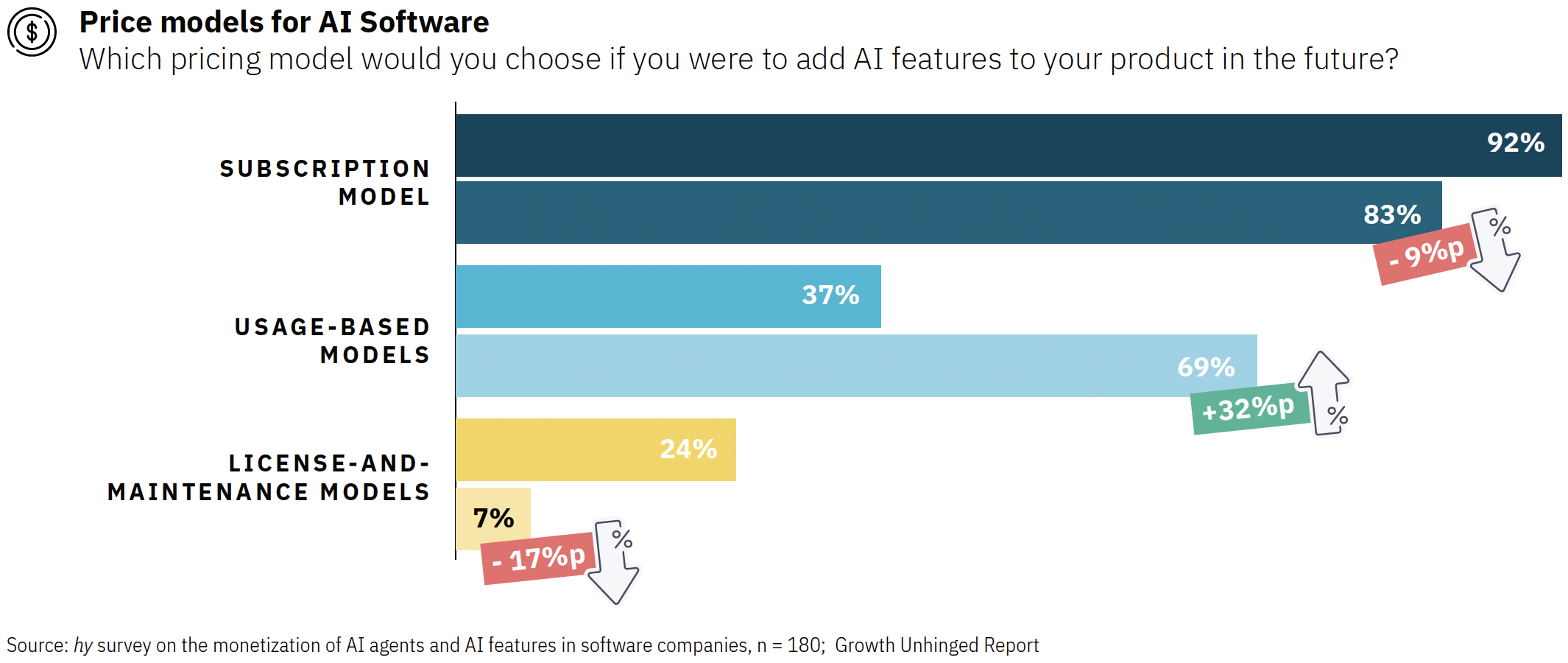

We see three major price models dominating the market, with the subscription model in particular used by almost all providers

The subscription model is the gold standard in today’s software industry. With a 92% adoption rate, it shapes monetization practice and is considered the industry benchmark for predictable, recurring revenue, ideal for products that deliver continuous value, such as SaaS solutions or digital platforms.

37% of providers also use usage-based models, where customers pay only for what they actually consume. These models are particularly well-suited for fluctuating demand

or transaction-based services, offering fair and scalable pricing.

The license-and-maintenance model is losing relevance, with only 24% of providers still using it.

Overall, the subscription model clearly remains dominant, but in practice, success often comes from finding the right combination of different approaches.

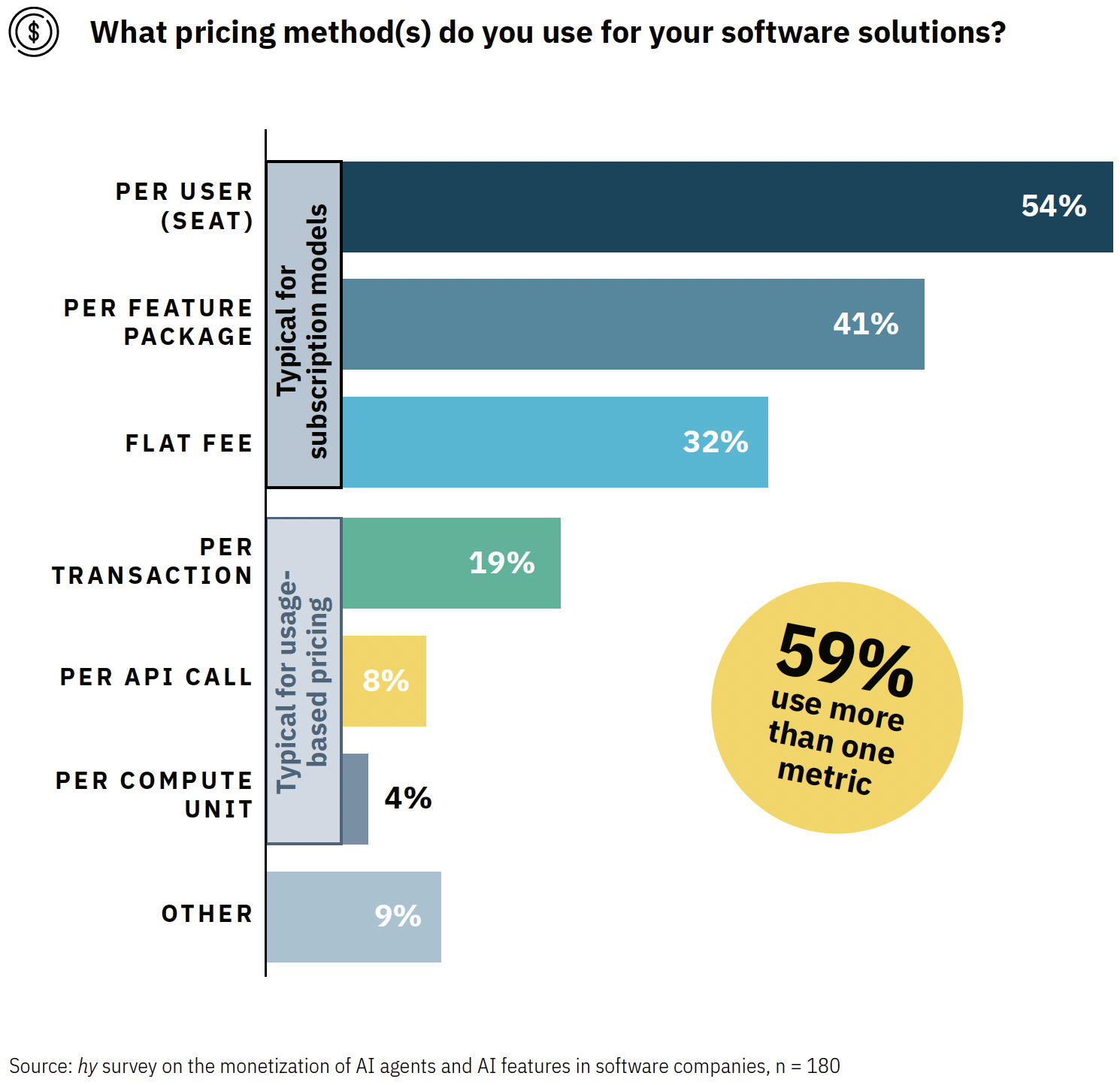

Due to the widespread use of subscription models, pricing metrics such as “per user” or “per feature package” also dominate

Among the price metrics used, two options currently dominate: 54% of providers charge per user, closely followed by 41% who price per feature package. Both approaches are typical for the subscription model and reflect its strong presence in the market.

At the same time, traditional models such as flat fees (32%) or transaction-based metrics (19%) remain relevant.

A notable trend is the rise of hybrid approaches: 59% of providers combine multiple pricing metrics, for example, user-based billing with API volume or computing power. This allows pricing to be more closely aligned with the actual value delivered.

Choosing the right metric is not a technical detail, but a strategic decision. A good price metric reflects the perceived value. The more clearly it does so, the more it drives growth and long-term customer retention.

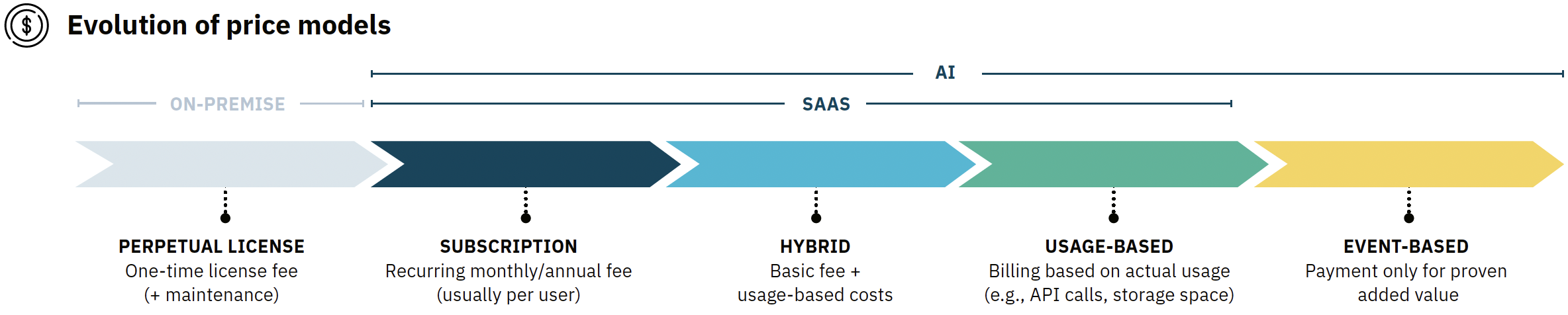

Technology and new software solutions are driving the shift from licensing and subscription models to usage- and resultsbased price models

In the past, software was sold through perpetual licenses and installed locally. With the advent of the cloud, the subscription era began, offering centralized delivery and recurring revenue.

Now, AI marks the next stage: usage can be measured in real time and priced based on consumption. Each prompt generates direct computing costs, especially for AI-native companies and large US players, who adapt their models accordingly.

Examples like Claude AI show how this works in practice: billing is usage-based, calculated on processed tokens. The more content created or analyzed, the higher the costs. Adobe, for instance, has adapted its price model for AI features with Firefly, using credits for AI-generated images or text effects.

The market is clearly moving toward hybrid and value-based models: more intelligent, adaptable, and aligned with the actual value delivered.

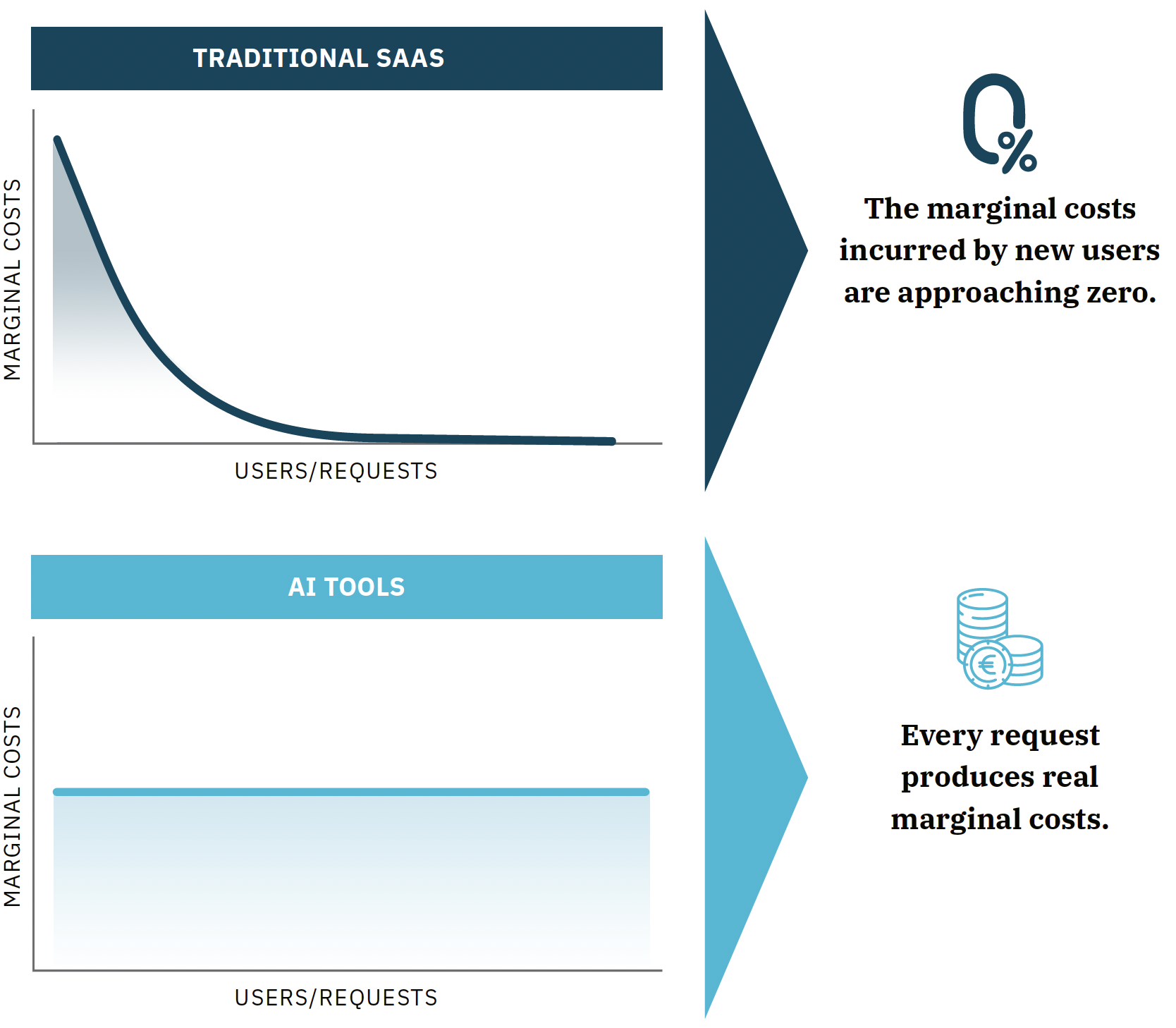

Variable GPU costs in AI tools are also forcing companies to rethink their pricing models and metrics

In the coming years, many are therefore planning to switch to a usage-based price model

Those who market AI features must also rethink their price models. While 92% of traditional software is still sold via subscriptions, the share for AI features is only 83%. Usage-based models are on the rise (from 37% to 69%), while license-and-maintenance models have dropped to 7%. In the US, the shift goes even further: 60% of providers rely on hybrid or usage-based models, while classic subscription approaches play a central role for only 32% of them.

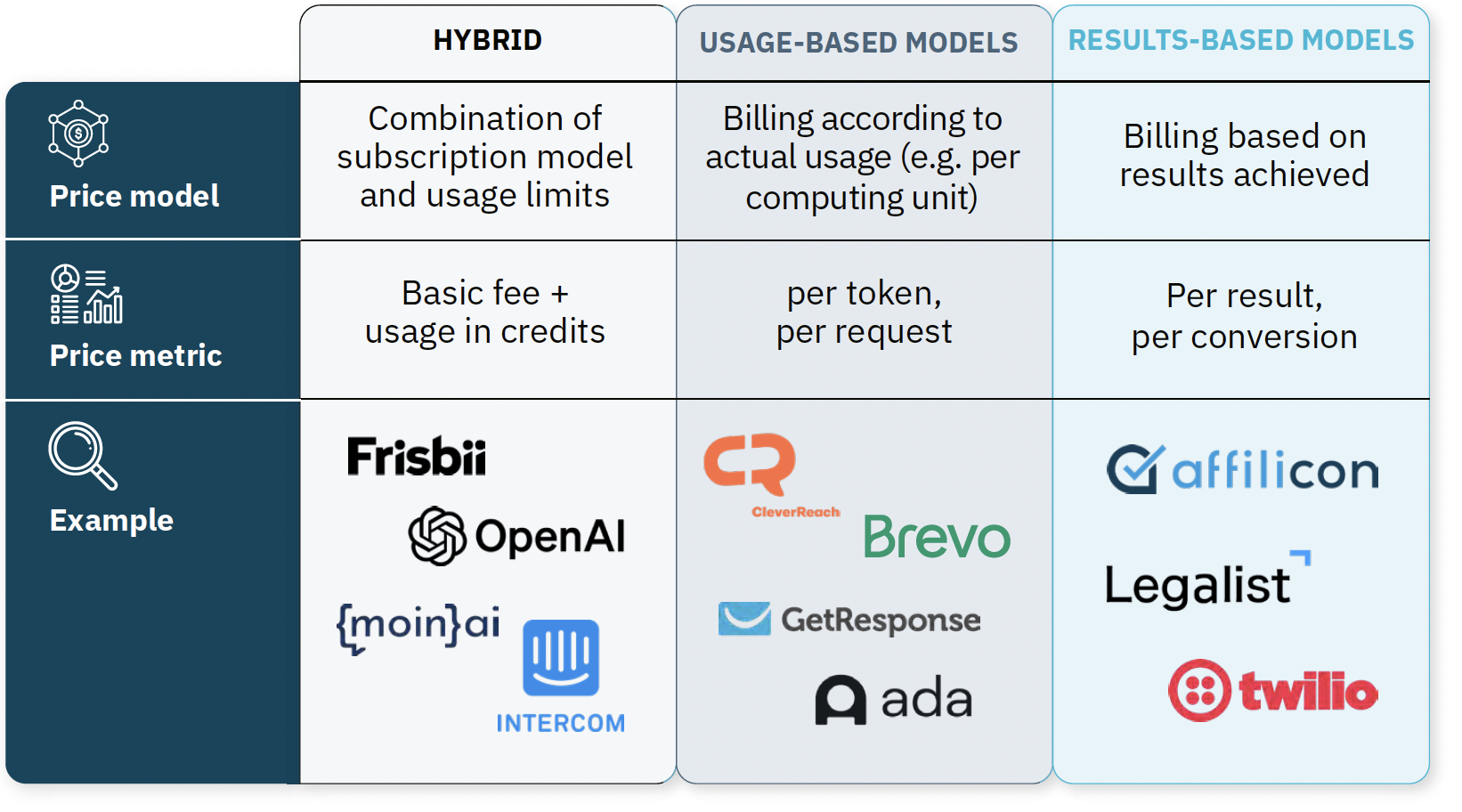

The three pricing models that will be most relevant in the future are already widely used in AI software today

The three central price models for AI software are already gaining acceptance: Hybrid models combine predictability with scaling potential. Usage-based models create transparency, lower barriers to entry and enable precise billing. Result-based models are geared towards real added value and share opportunities and risks with the customer.

All three promote fair, flexible and growthoriented monetization, in line with the dynamics of modern AI solutions.

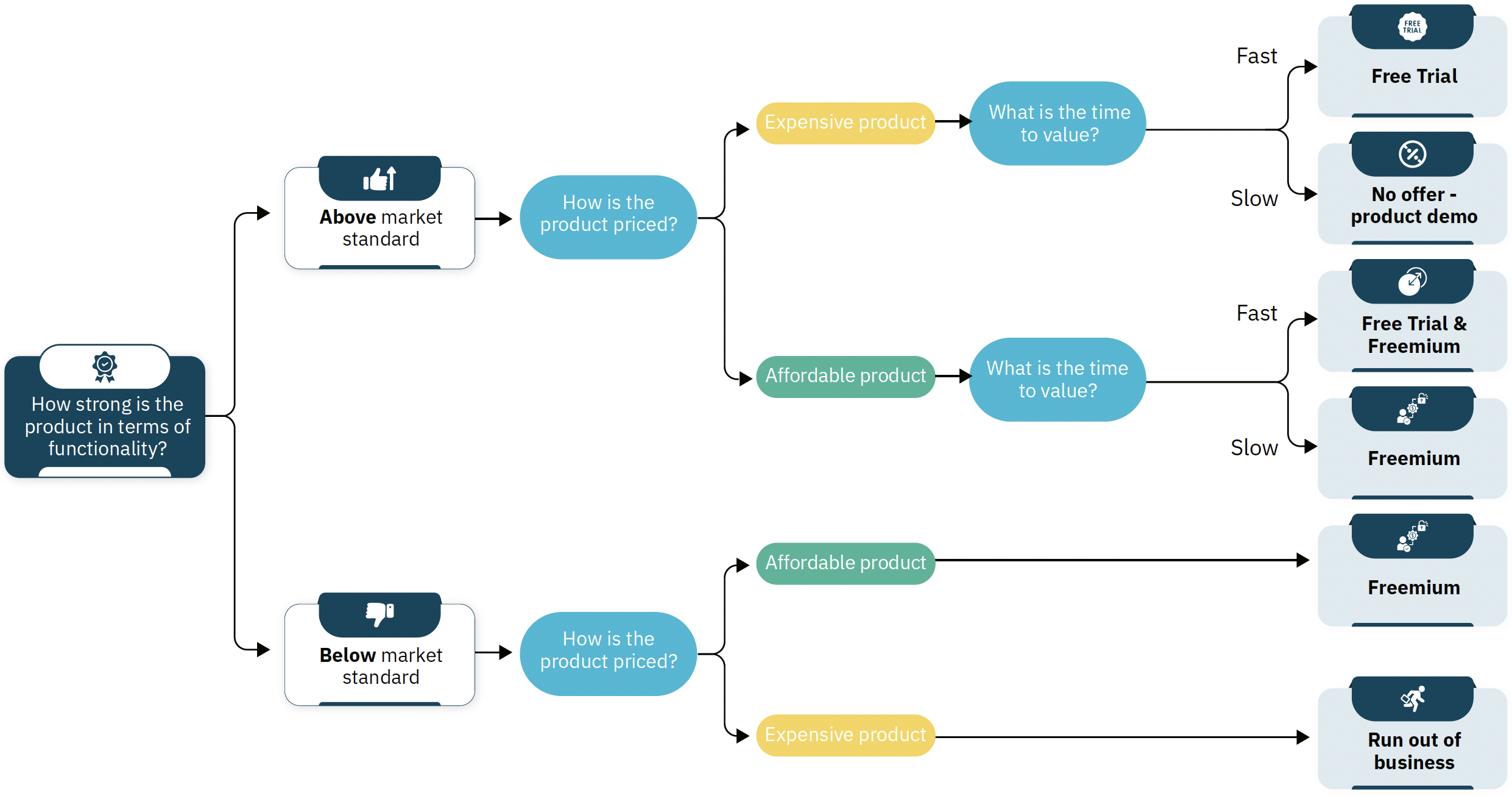

We also see that market conditions and the necessary infrastructure are often lacking to enable event-based pricing

Especially in the field of AI, many providers face the challenge of developing an appropriate pricing model. Market standards often do not yet exist, and the necessary structures to accurately measure outcomes are not always in place. To still make well-founded decisions, a structured approach is essential.

A decision framework helps to systematically select the right model.

- If a headcount position is directly replaced, an agent-based pricing model is suitable, positioning the agent as a fractional FTE and targeting the headcount budget.

- If clear outcomes can be measured, an outcome-based model is recommended, where only results are priced and proof of value creation is required.

- When results are not clearly measurable, the question is whether task volumes vary significantly. If they do, a usage-based model is appropriate, operating as a consumption model that can evolve further.

- If task volumes are relatively stable, a usage-based model is preferable, charging “per process” and balancing simplicity with value creation.

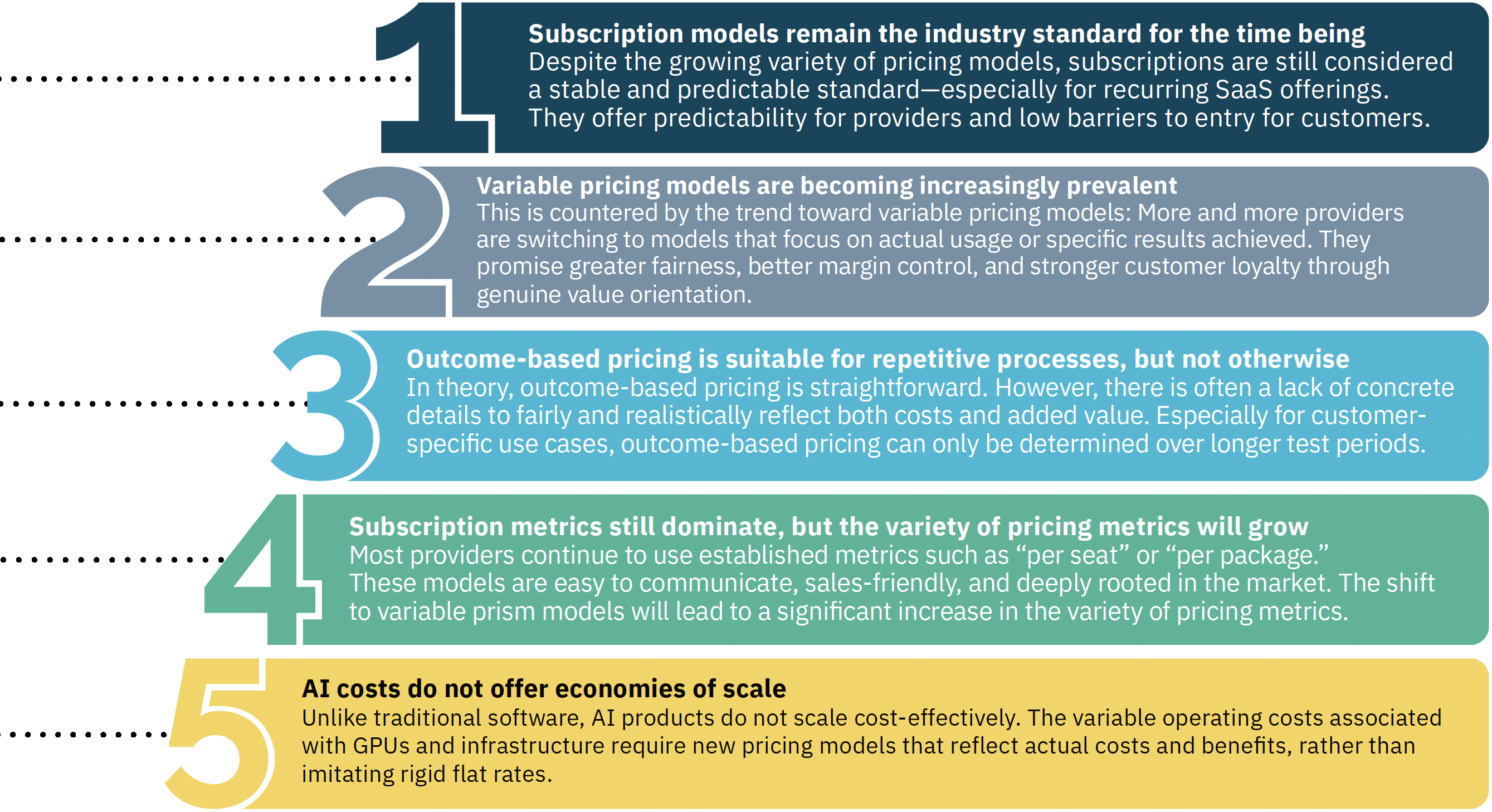

Top 5 insights into pricing models and metrics

Packaging

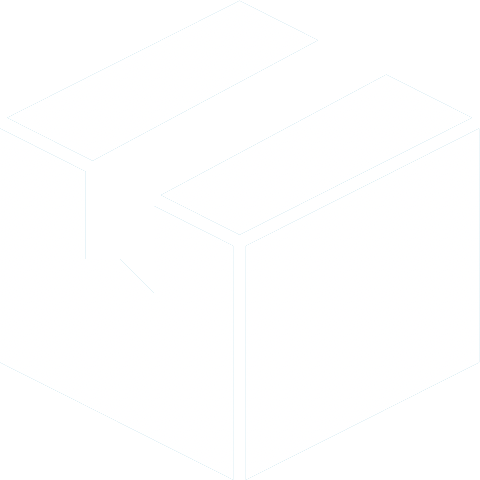

The technical flexibility of SaaS products has resulted in many different packaging options

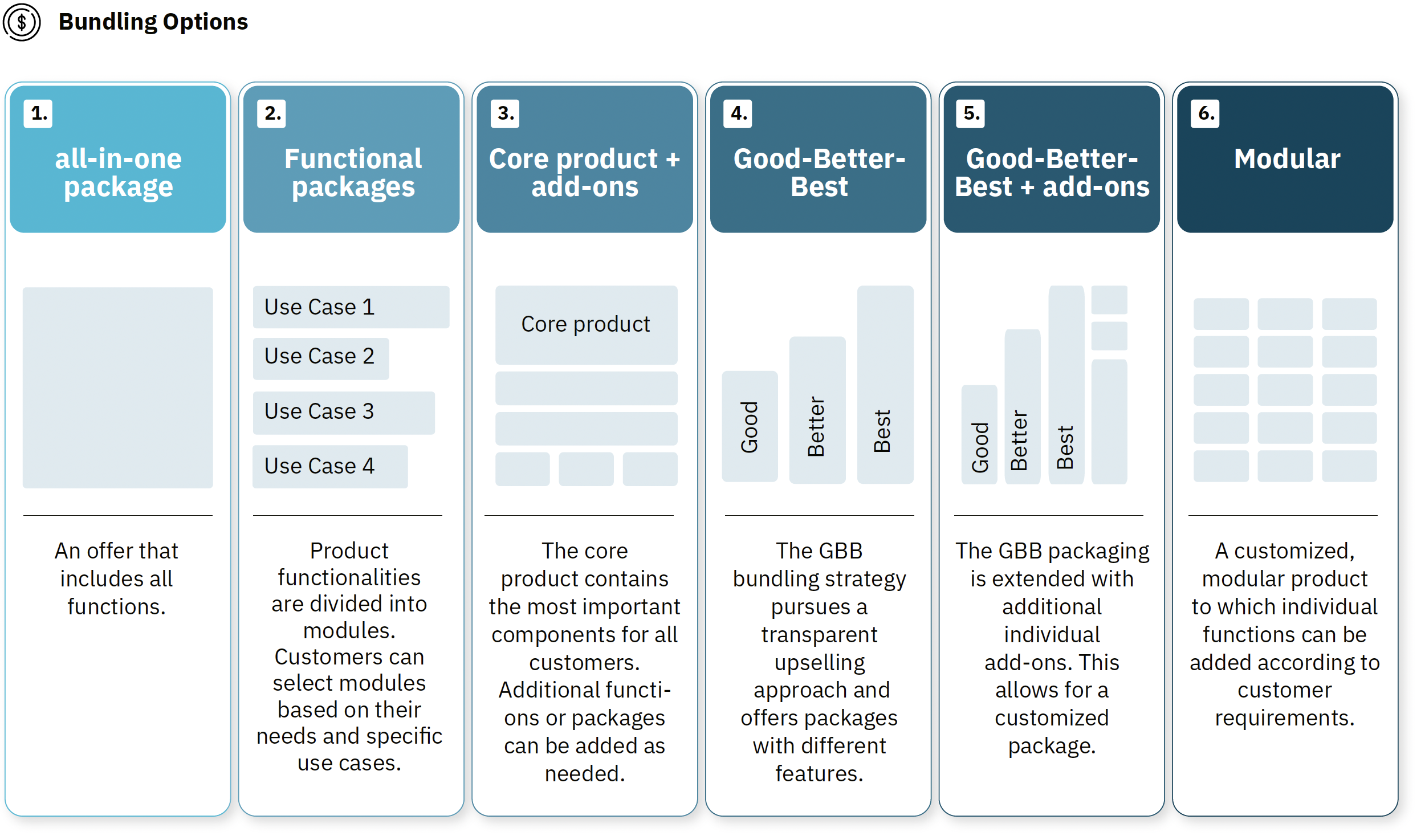

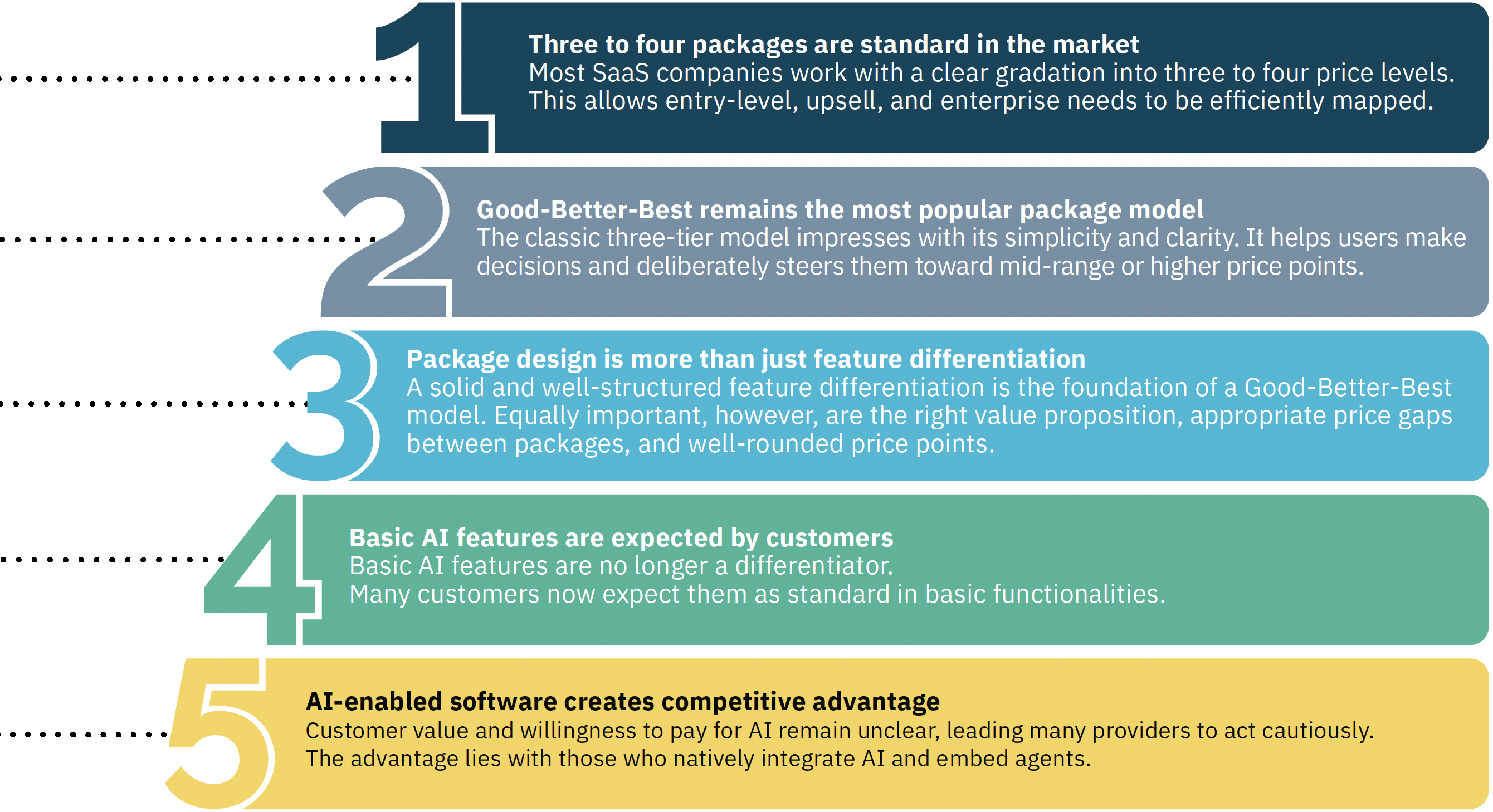

In the SaaS sector, there is a clear trend toward three or four packages—fewer or more packages are the exception, but can still be useful

A look at the SaaS providers listed on OMR Reviews reveals a clear pattern: most offer three packages, and some offer four, typically using the proven good-better-best approach. This model provides a clear structure and makes navigation easier while creating comprehensible differences in performance.

Providers with more than four packages usually offer modular solutions with a focus on adaptability to customer-specific use cases. To communicate a clear value proposition to customers, it‘s important that the packages remain distinguishable and don‘t compete with each other, and that the selection process remains intuitive.

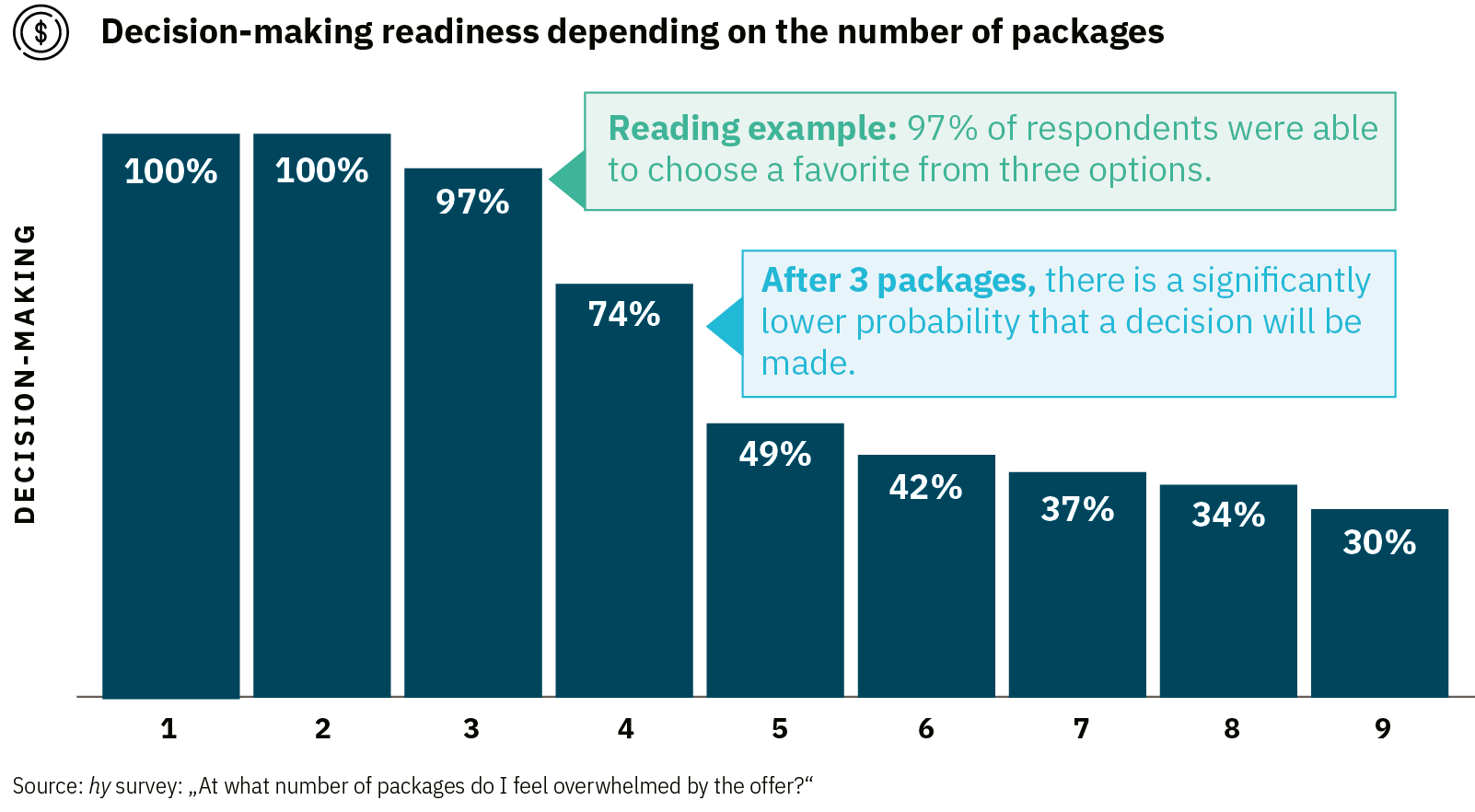

From a psychological perspective, users prefer clarity: three packages are good, but after that, the willingness to make a decision decreases significantly …

When it comes to the number of price packages, less is more.

Our survey shows that three options provide the best framework for an efficient, targeted purchasing decision. Psychologically, willingness to make a decision declines significantly with the fourth option, as too many choices quickly become overwhelming. Too few options, on the other hand, carry the risk that potential customers will not find a suitable offer, particularly when targeting diverse groups.

Three clearly differentiated packages strike the optimal balance between variety and ease of decision-making.

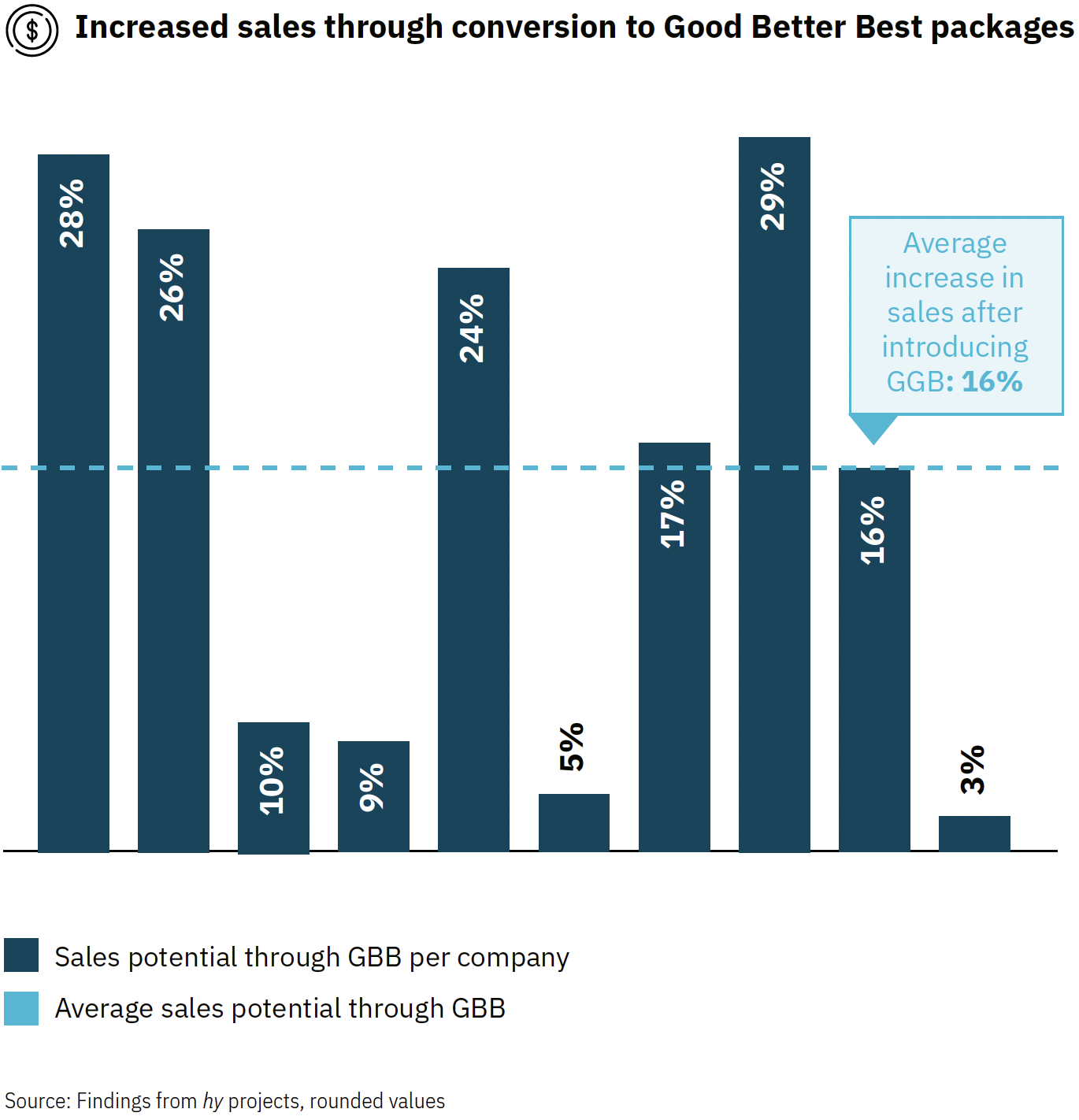

…but the added value is also evident from a financial perspective: our projects demonstrate the significant revenue leverage achieved through the introduction of GBB

Increased sales through switching to Good-Better-Best.

Our analysis shows that companies that switch to clearly structured Good-Better-Best models significantly increase their sales–by an average of 17%, and in some cases by almost 30%.

The reason: GBB packages provide guidance. They help customers better understand the value of higher-priced options, thereby increasing the likelihood that they will choose the most suitable package rather than the cheapest one. The changeover does not require any new products–just clever packaging of existing services with clear differentiation.

For the Good-Better-Best model to work, the product design must also be geared towards it

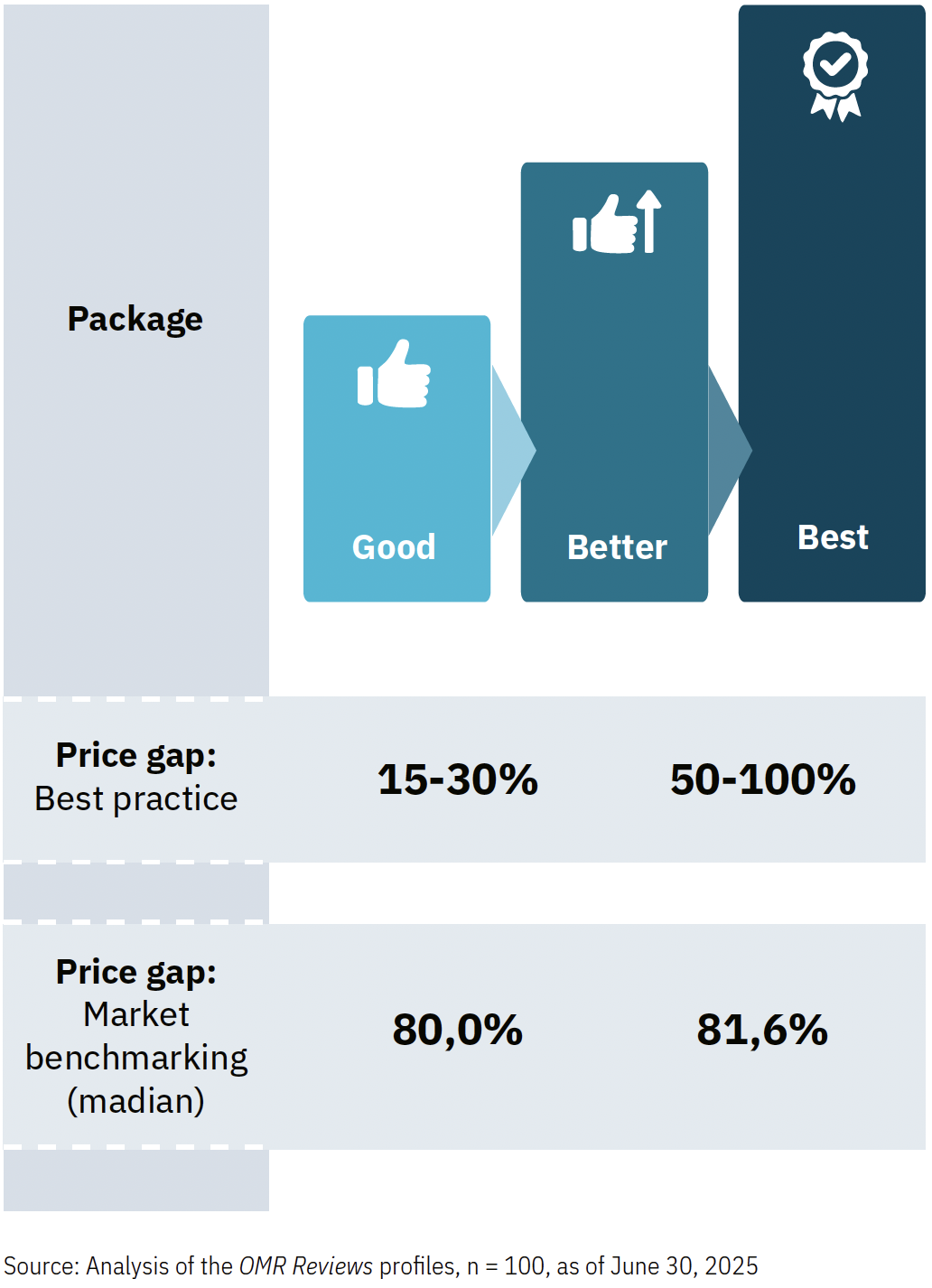

The optimal price difference should be around 15% between “Good” and “Better” and 50% to “Best”

A clear pricing structure is crucial for SaaS providers to increase conversions and upgrades. Often, the gaps between packages are too large, making it difficult for customers to decide.

The price jump between the entry-level and mid-range packages should be kept small (ideally 15-30%). The jump to the premium package can be larger (50-100%). This strategy, in which the mid-range package offers the highest value, leads to greater willingness to pay and higher conversion rates.

Logical price scaling improves controllability and builds trust.

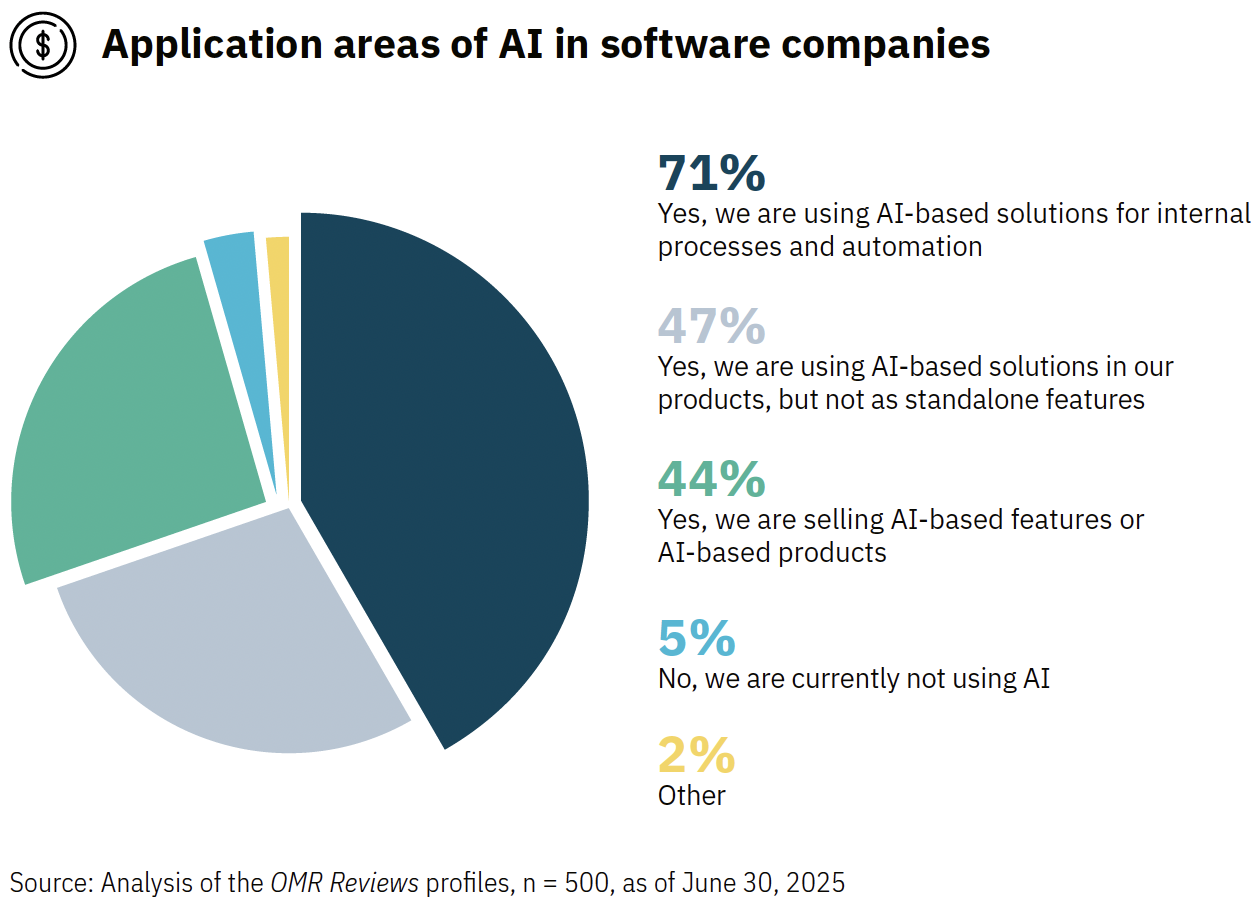

AI integration in the product landscape of SaaS companies is around 40%, both in the form of standalone products and AI-supported features

The survey results clearly show that the use of AI in companies is now widespread. At 70.9%, the majority use AI-supported solutions primarily to automate internal processes. This focus on efficiency and operational optimization illustrates that AI is primarily used where clear economies of scale can be achieved. At the same time, 47% of respondents say they use AI in their products—but not as a standalone feature. This suggests that AI is increasingly being integrated into existing offerings, but often remains in the background and is not marketed as a differentiating feature.

44.0% of companies already offer AI-supported features or standalone AI products, underscoring the trend toward active productization of AI. These companies are positioning themselves as significantly more innovative and are using AI specifically to expand their range of services.

This shows that AI is no longer seen as an option, but as a standard tool, both internally and in the market. Companies now use AI on several levels, from increasing internal efficiency to actively differentiating their product.

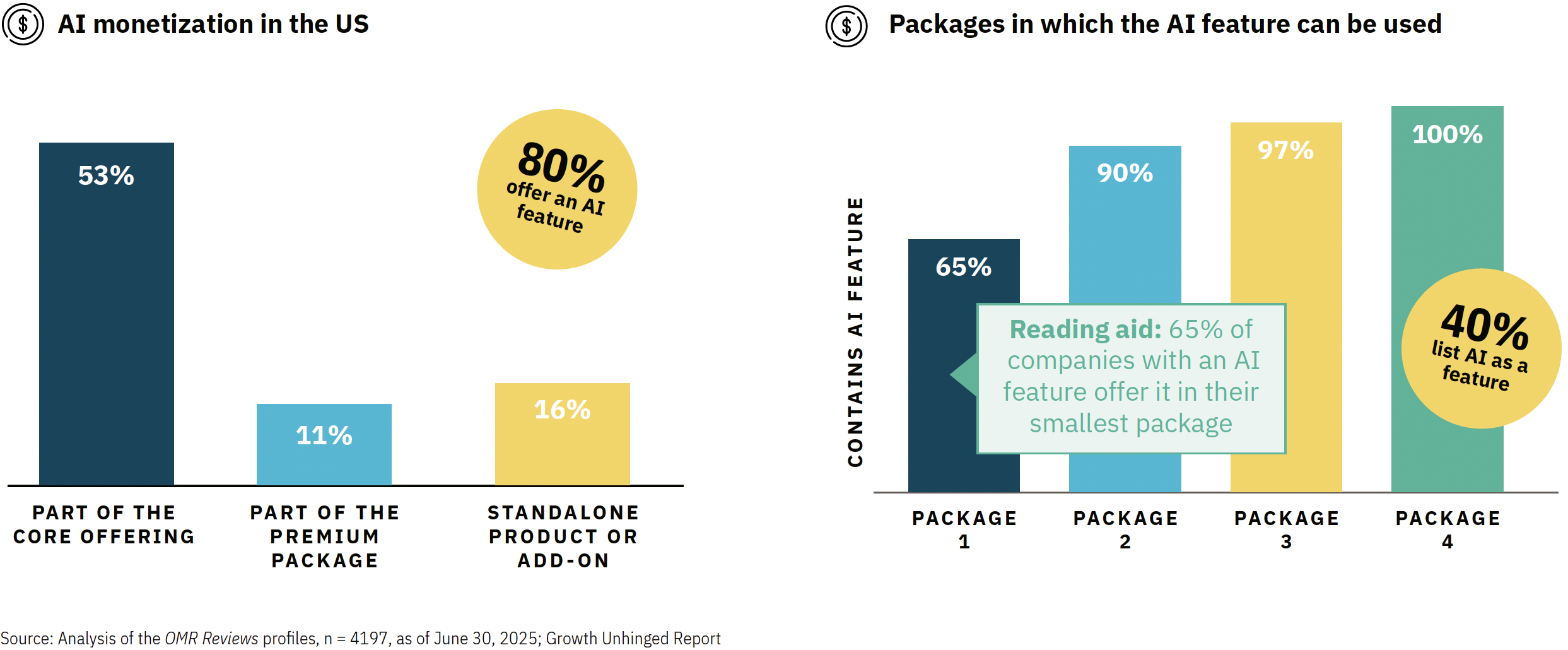

In both the U.S. and Germany, we see that AI features are now considered a commodity in the core offering

In the US, only 20% of SaaS companies do not offer AI features. More than half of all providers already integrate AI functions into the standard version of their product. A similar picture is increasingly emerging in Germany: although only 40% of companies list an AI offering at all, the market dynamics are comparable among those that do. 65% already provide AI features in their cheapest package, and 90% of providers offer them in their second-cheapest package onwards. This signals that those who offer AI are quickly making it part of their core business, with clear implications for differentiation and monetization. Those who have an AI feature use it as a flagship and also want it to be used.

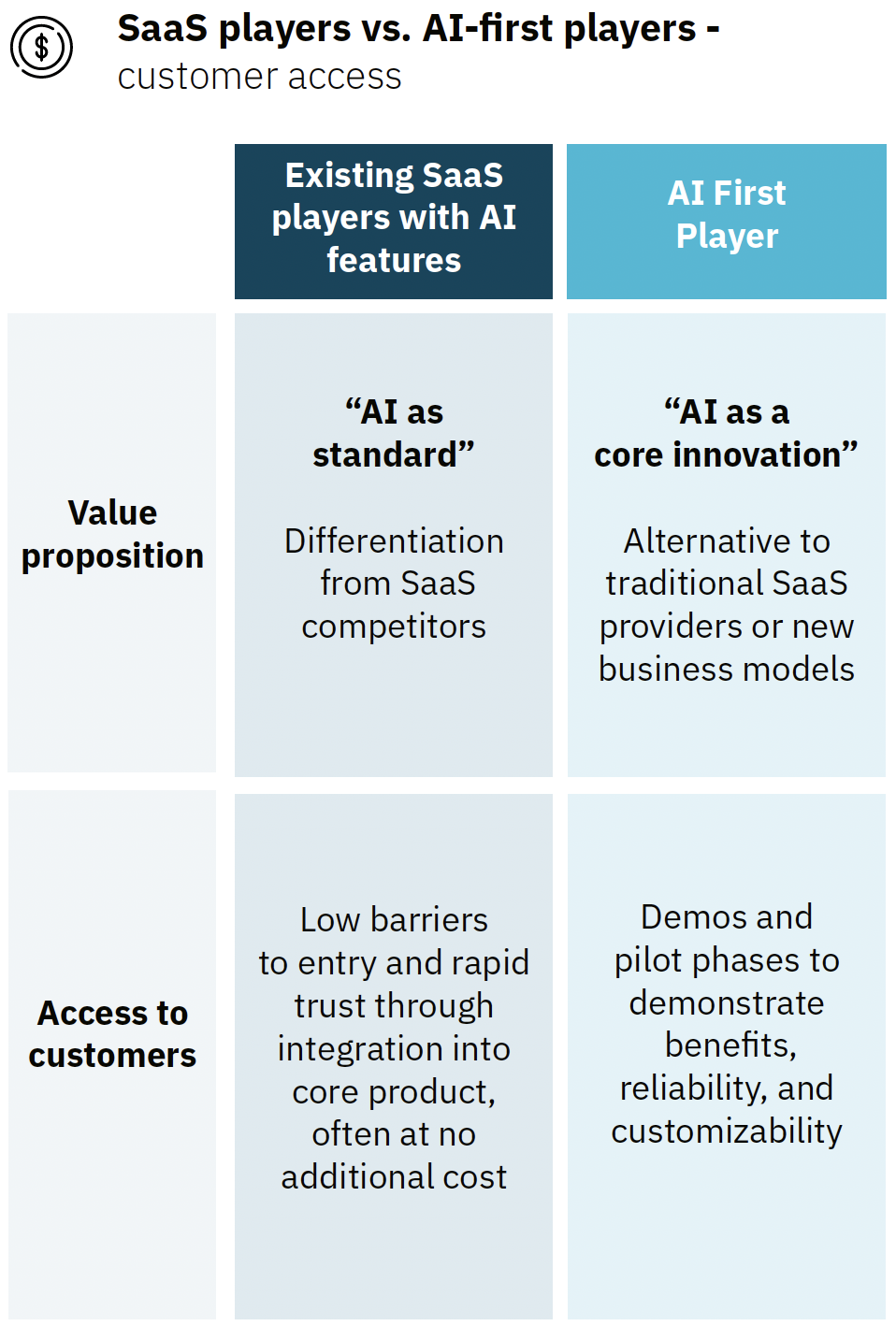

While SaaS players integrate their AI features into existing packages, new AI players first have to prove their added value

Many SaaS companies integrate their new AI functionalities directly into the basic package. For new customer business, this means that instead of monetizing AI features separately, AI is used as a “wow factor” to secure the initial contract. Monetization then shifts to upgrades, usage volume, or AI-specific premium credits—once customers have experienced the true added value in their everyday lives.

This makes it clear that SaaS companies are using their market position and existing customer base to make AI part of their basic package as a growth driver. The focus is not on the additional fee, but on increased conversion and customer loyalty.

Companies gain competitive advantages when they make their software AI-capable and provide APIs that external AI agents can access

The specific customer benefits and willingness to pay for AI products are still unclear in practice. SaaS CXOs are currently responding cautiously and often integrating AI features into basic offerings free of charge.

At the same time, investors and AI-native companies are experimenting intensively to better understand the market, usage models, and willingness to pay.

Despite the uncertain future, clear scenarios are emerging – from deeply integrated AI to complete disruption. Instead of seeing AI agents as a threat, SaaS providers should view them as an integral part of their platforms.

The competitive advantage lies with those who natively integrate AI functions and create interfaces for external agents. Especially in specialized SaaS markets, agentic AI is increasingly becoming a value-adding additional service.

Top 5 insights on packaging

Price points

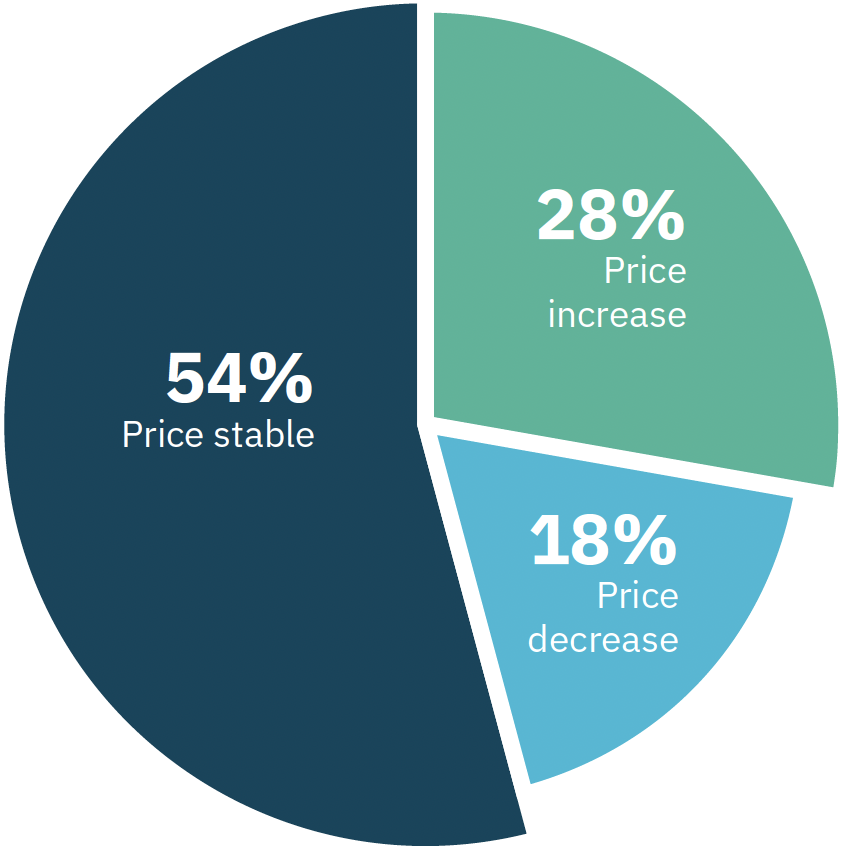

Most SaaS companies adjust their subscription prices regularly. Last year alone, approximately 54% of the companies analyzed changed their price points

With the shift from license-based to subscription-based models, not only has the payment logic changed, but more importantly, the way price points are structured. While one-time purchase prices in the license business often remained unchanged for years, subscriptions allow for significantly greater flexibility at the price level.

Today, providers can adjust their prices with comparatively little effort. The reasons for this are manifold:

- New features: When additional functionalities are introduced, providers can increase the price level of a tier or introduce an additional package.

- Inflation and rising operating costs: Price levels can be gradually raised without having to restart the entire sales process.

- Competitive dynamics: Providers can react flexibly to price increases in the market by aligning their own tiers accordingly.

In the license model, this was impossible: customers made a one-time purchase, and updates or new versions were either included for free or had to be sold as an entirely new product generation. Active management of existing price levels essentially did not exist. Today, the opposite is true. Subscription models make it possible to move existing customers into higher-priced tiers or periodically adjust base prices.

Pricing has thus become a strategic lever to secure revenue growth and maintain stable margins—a key differentiator compared to the old world of license models.

Source: Analysis of the OMR Reviews profiles, n = 100, as of June 30, 2025

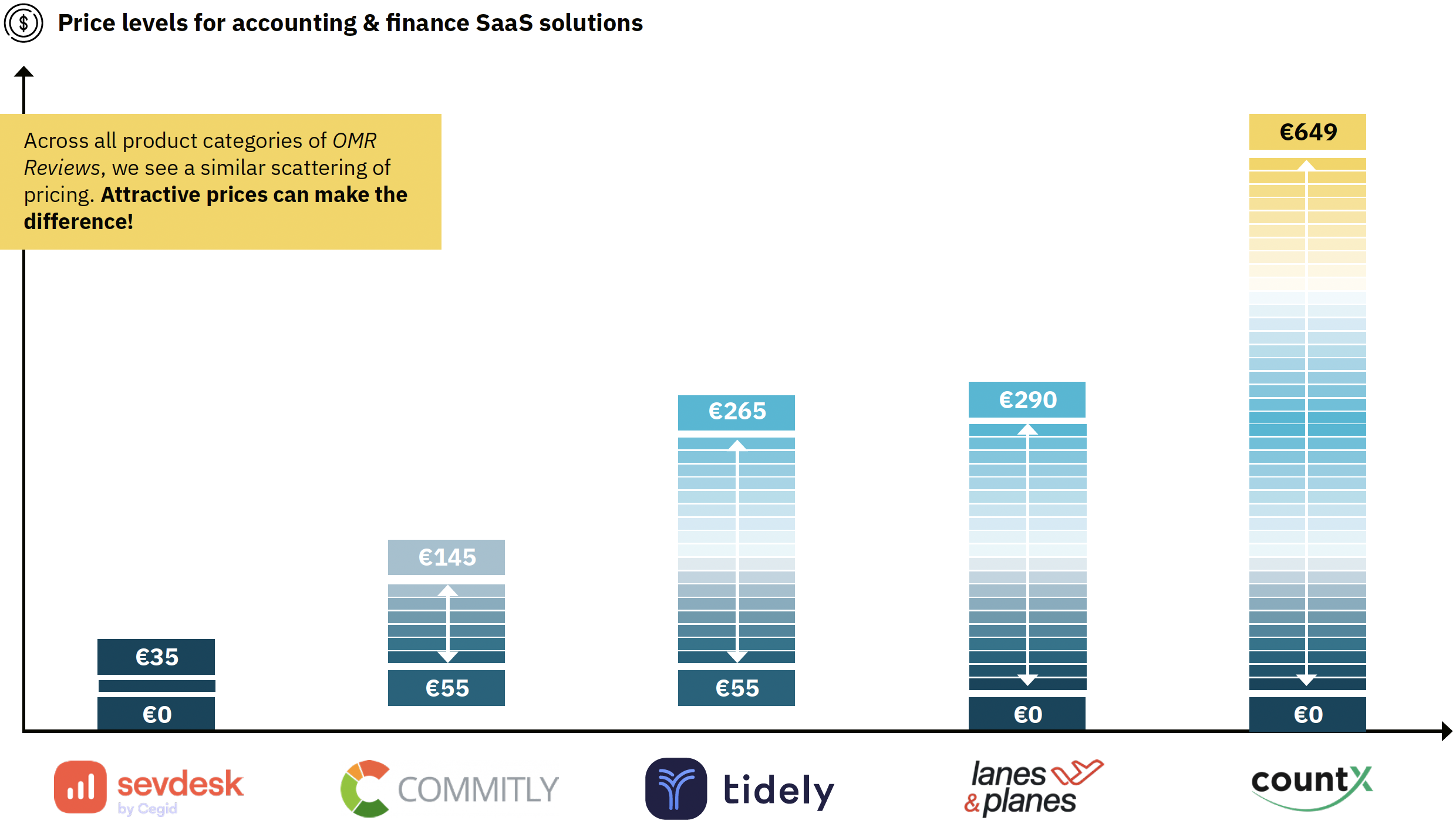

The result: SaaS price levels are highly individual and vary greatly even within the same product category

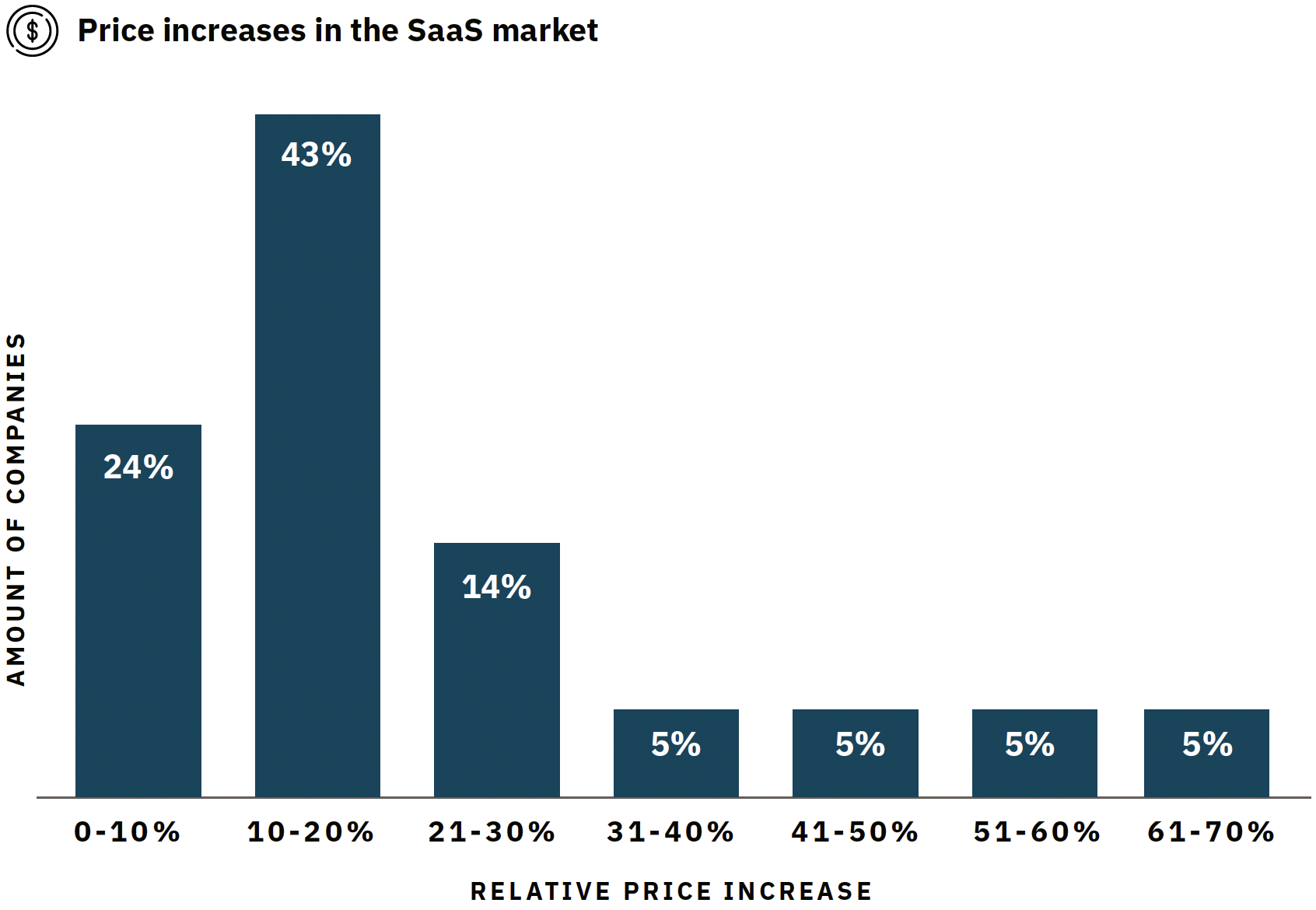

In the past year, companies offering three or four packages raised the price of their cheapest offering by 10%

Price increases between 0-20% dominate: More than two-thirds of companies (67%) fall within this range. This indicates that these adjustments are standard practice in the market and easiest to communicate.

Significant adjustments are less common: Only 20% exceed a price increase of 30%. Clear product improvements, increased costs, or a strong brand position often play a role here.

Upward outliers: Around 15% of companies have implemented price jumps of over 30%. This is rather the exception and is likely to work primarily in cases with high customer benefit, low price sensitivity, or a strong lock-in effect.

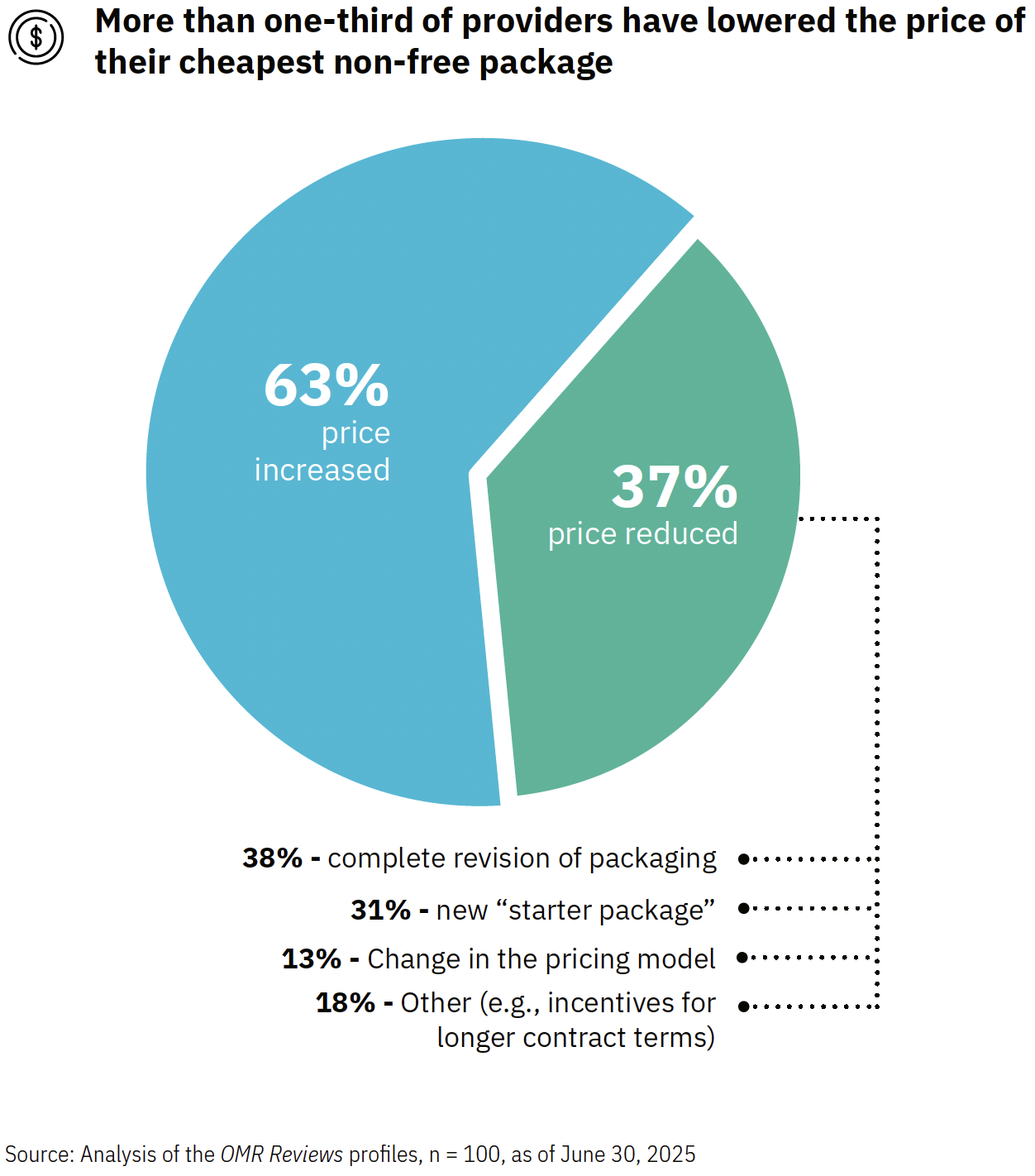

Source: Analysis of the OMR Reviews profiles, n = 100, as of June 30, 2025

We also see that cheaper packages are being added to reduce barriers to entry

As expected, the majority of price changes (approx. 60%) are price increases. However, 37% of price changes are due to lower entry-level prices.

A more affordable entry-level package with limited functionality significantly reduces the barrier to entry for new customers. This makes it easier to get started with the product range, which promotes customer loyalty in the long term.

A free basic version can also be an effective lever for customer acquisition. This potential can be effectively monetized through targeted upselling strategies or the subsequent expiration of limited-time, free trial periods.

Last year alone, approximately 10% of the companies surveyed added a free version of their product to their portfolio.

The communication of price points also has a psychological component and offers potential when executed correctly

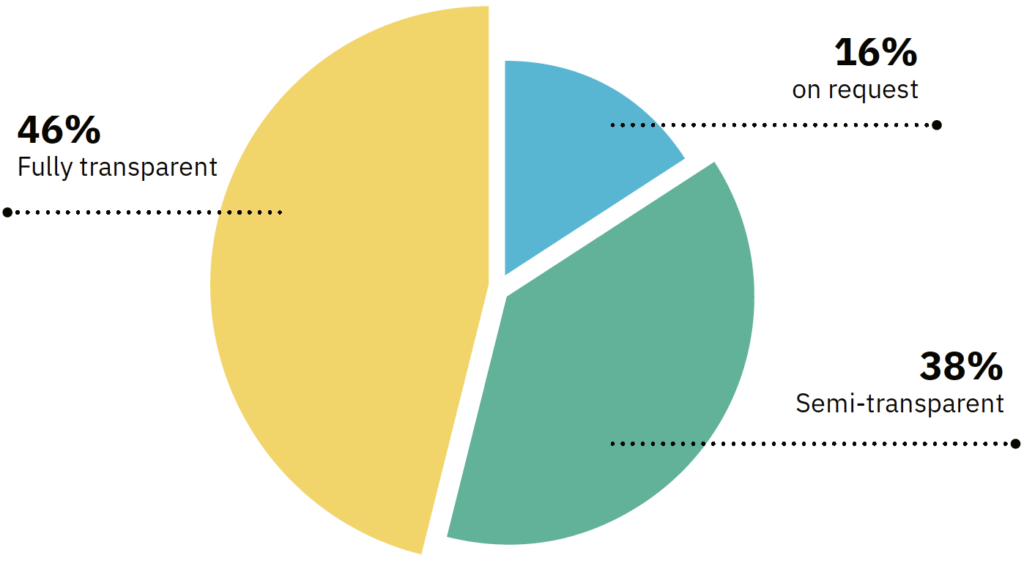

When does price transparency make sense?

Price transparency makes sense when the offering is clearly defined and standardized. Purchasing decisions are accelerated because prospective customers can immediately compare value and costs. At the same time, it highlights the competitive advantage and strengthens the confidence of self-service customers who want to make a purchase without a sales conversation.

When is “on request” preferable?

On Request is recommended for complex and individual projects where volume and specific requirements have a major impact on price. Price transparency allows strategic flexibility to be maintained and creates an opportunity to initiate a personal sales discussion.

The same applies to price anchors and price rounding. Small adjustments can make a difference in the sales process

PRICE ANCHOR

How does anchoring work?

With price anchoring, a deliberately high price is set, for example, through an expensive package or an additional product. This price serves as a mental reference point. Customers unconsciously use it as a guide when evaluating other options. Even a price that is actually high appears cheaper in comparison. This increases willingness to pay without the need for discounts or real price changes.

PREISRUNDUNGEN

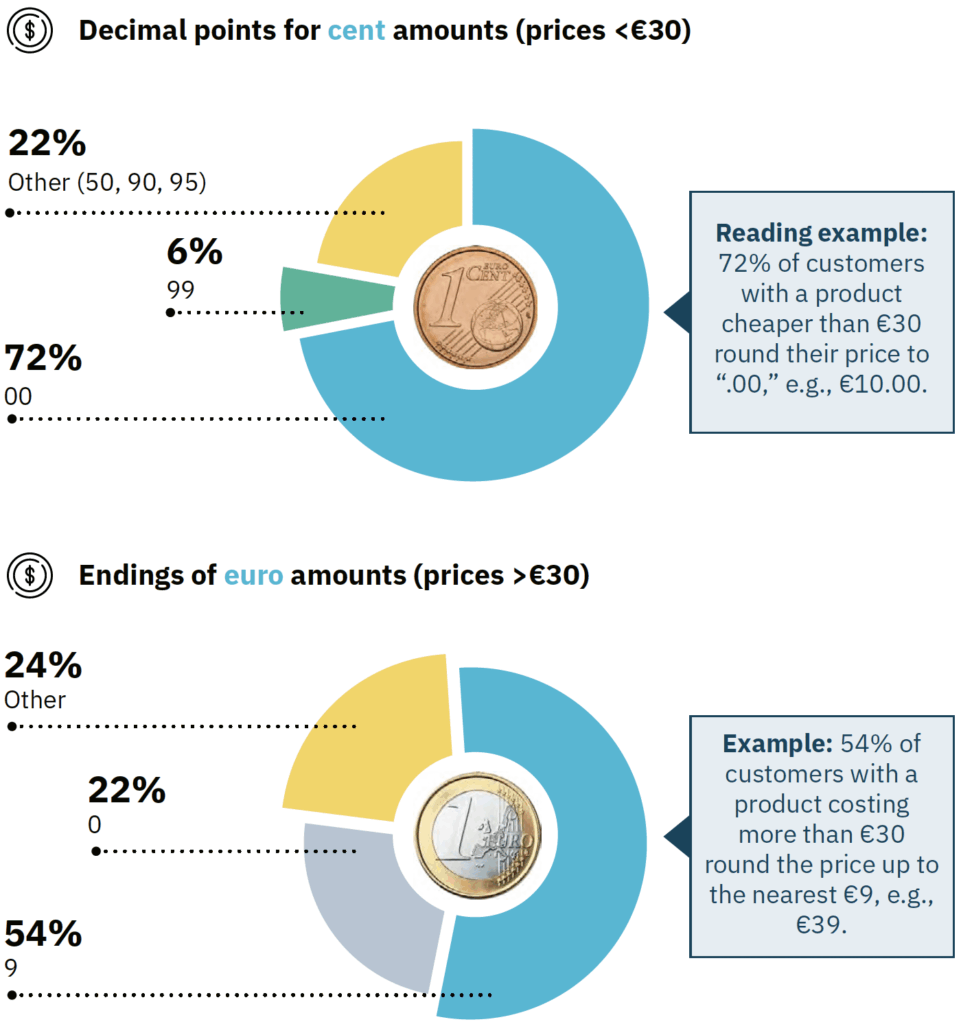

How are prices rounded correctly?

Price rounding subtly but effectively influences price perception. Smoothly rounded prices (e.g., €100) appear high-quality, professional, and trustworthy— especially for premium products or in a B2B environment. Odd prices (e.g., €99,90), on the other hand, signal a good deal and can promote sales among pricesensitive target groups. Depending on positioning and target group, rounding should be used strategically, as it influences purchasing behavior more than many people think.

For prices below €30, it is particularly advisable to use round euro amounts. They appear clear, facilitate quick purchasing decisions, and create a feeling of fairness. Above €30, endings with the number 9 are particularly effective. They take advantage of the threshold price effect, but should be tested against round endings such as 0 or 5, as these can convey a stronger premium character. As a general rule, price variants should always be tested using A/B testing to reliably measure their effects on conversion, margin, and returns.

Will prices for software fall as a result of AI transformation, and will SaaS providers come under pressure?

In the past, software price levels, especially for SaaS products, were often high. Companies could charge premium prices because their solutions solved complex problems and delivered significant value. Lock-ins were strong, and customers could usually only exit their SaaS contracts at high switching costs.

The rapid rise of AI products, particularly standalone agents that access company data or publicly available information directly via APIs, is fundamentally reshaping this market. These solutions bypass traditional UI workflows, automate repetitive tasks, and make core functions of many SaaS tools accessible with far less effort. For customers, this creates a new basis of comparison: what used to be a feature of a SaaS product can now be performed by a standalone AI agent at a fraction of the price.

This generates pressure, on product, positioning, and pricing. We see that the majority of SaaS firms adjust their prices regularly by around 10%, often well above the inflation rate. Whether this room for maneuver will persist in an AI-driven competitive environment remains uncertain. Many of the SaaS experts we interviewed confirm that AI features are currently being integrated into the core offering rather than monetized separately.

Our hypothesis: providers are reluctant to fundamentally change their proven pricing models for now, instead using AI to legitimize existing price points and justify the next “learned and accepted” price increase.

In the long run, however, this approach will not be sufficient. As AI functionalities mature and become more differentiated, customer expectations will shift, and with them the entire pricing structure of the market.

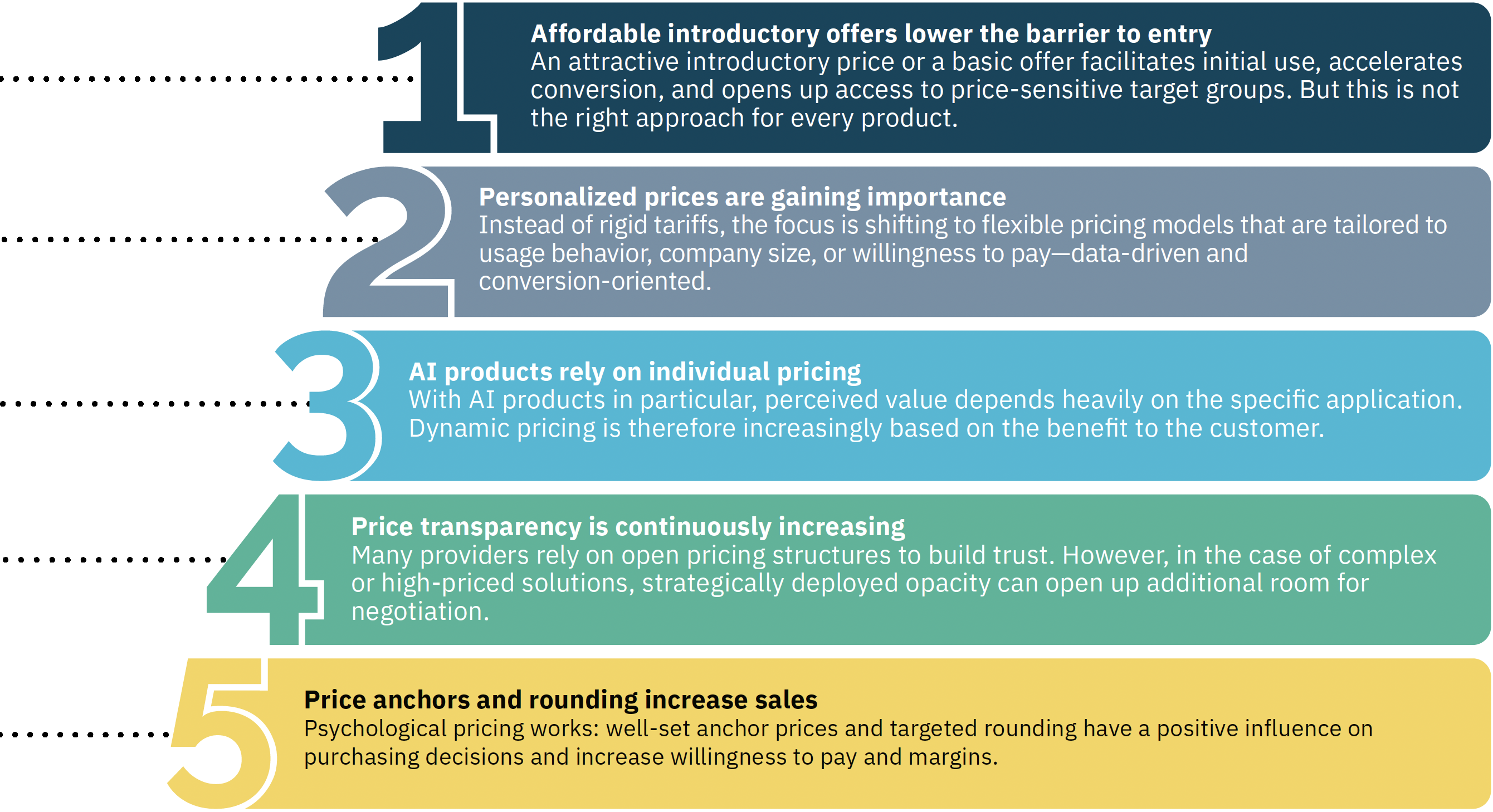

Top 5 insights on price points

New customer models

Acquire More Customers with Smart Models: How Free Trial, Freemium, and Reverse Trial Simplify the Path to Paid Plans

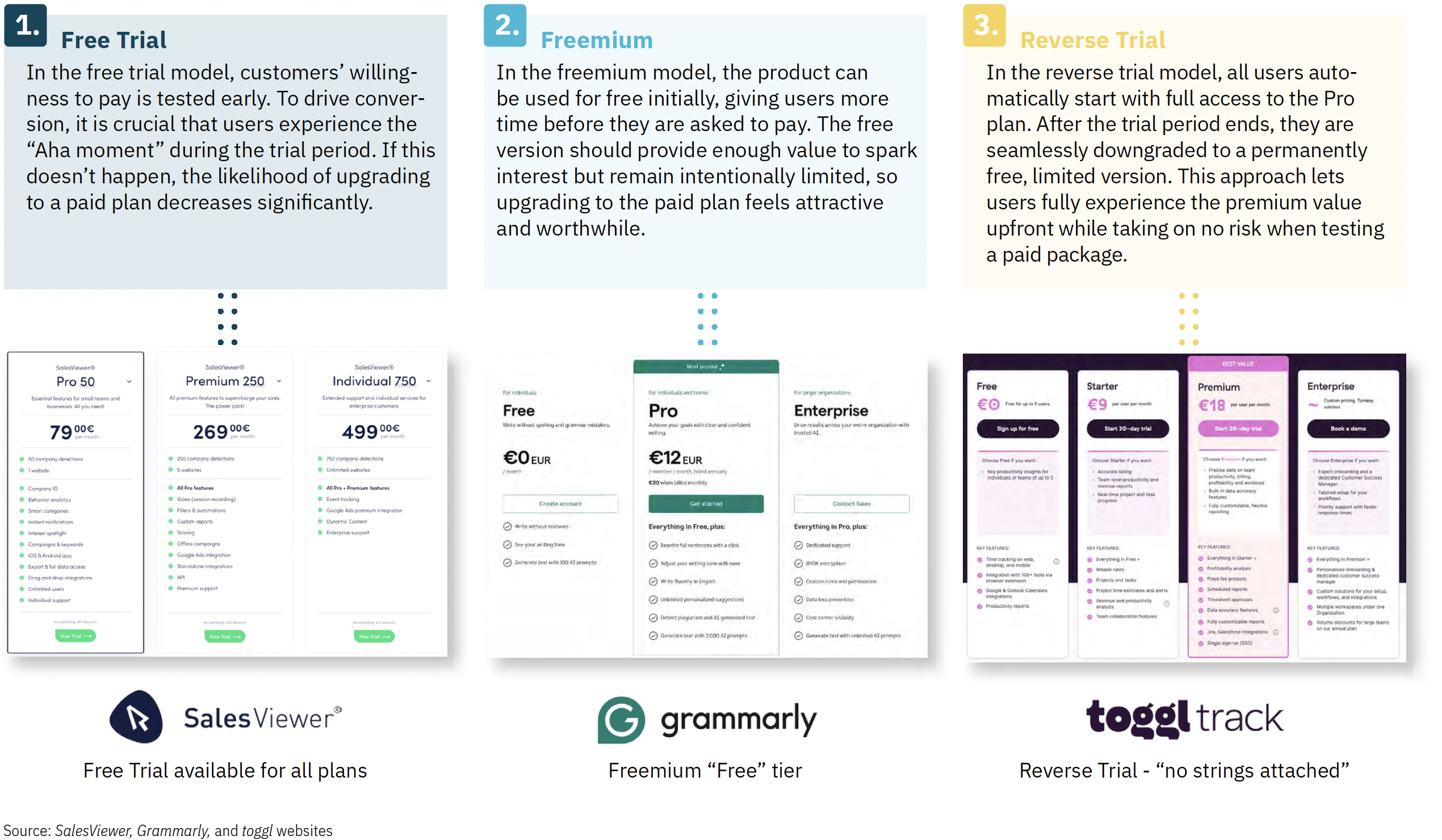

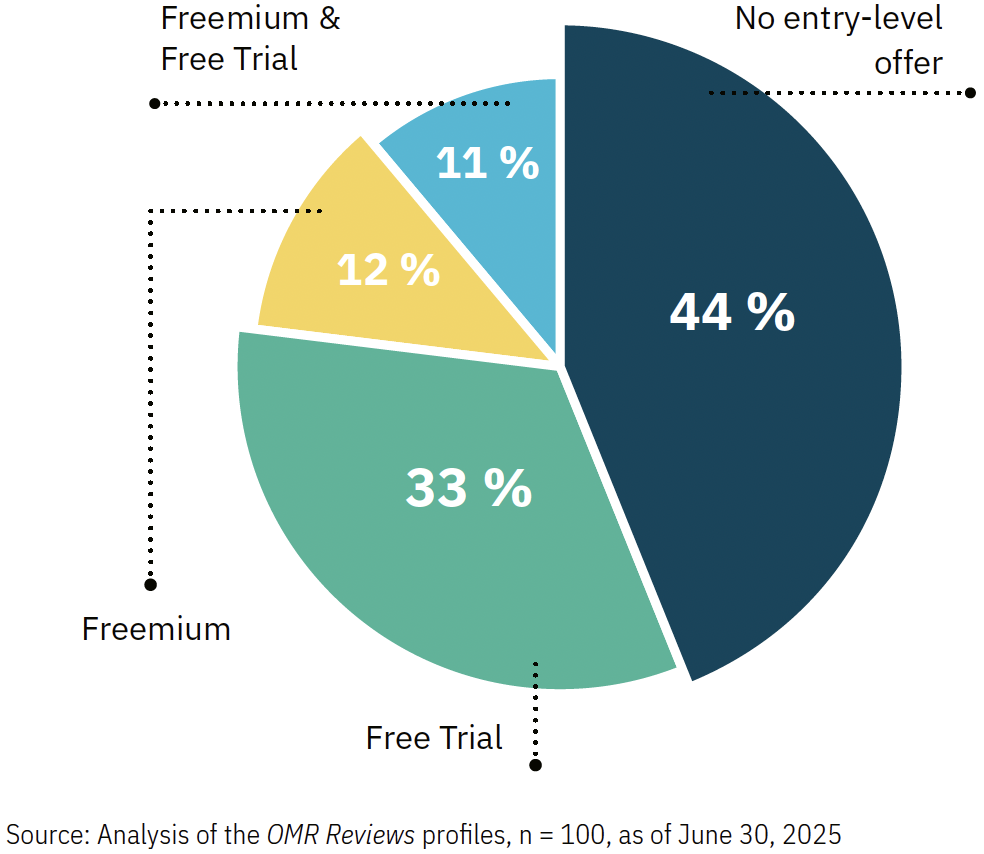

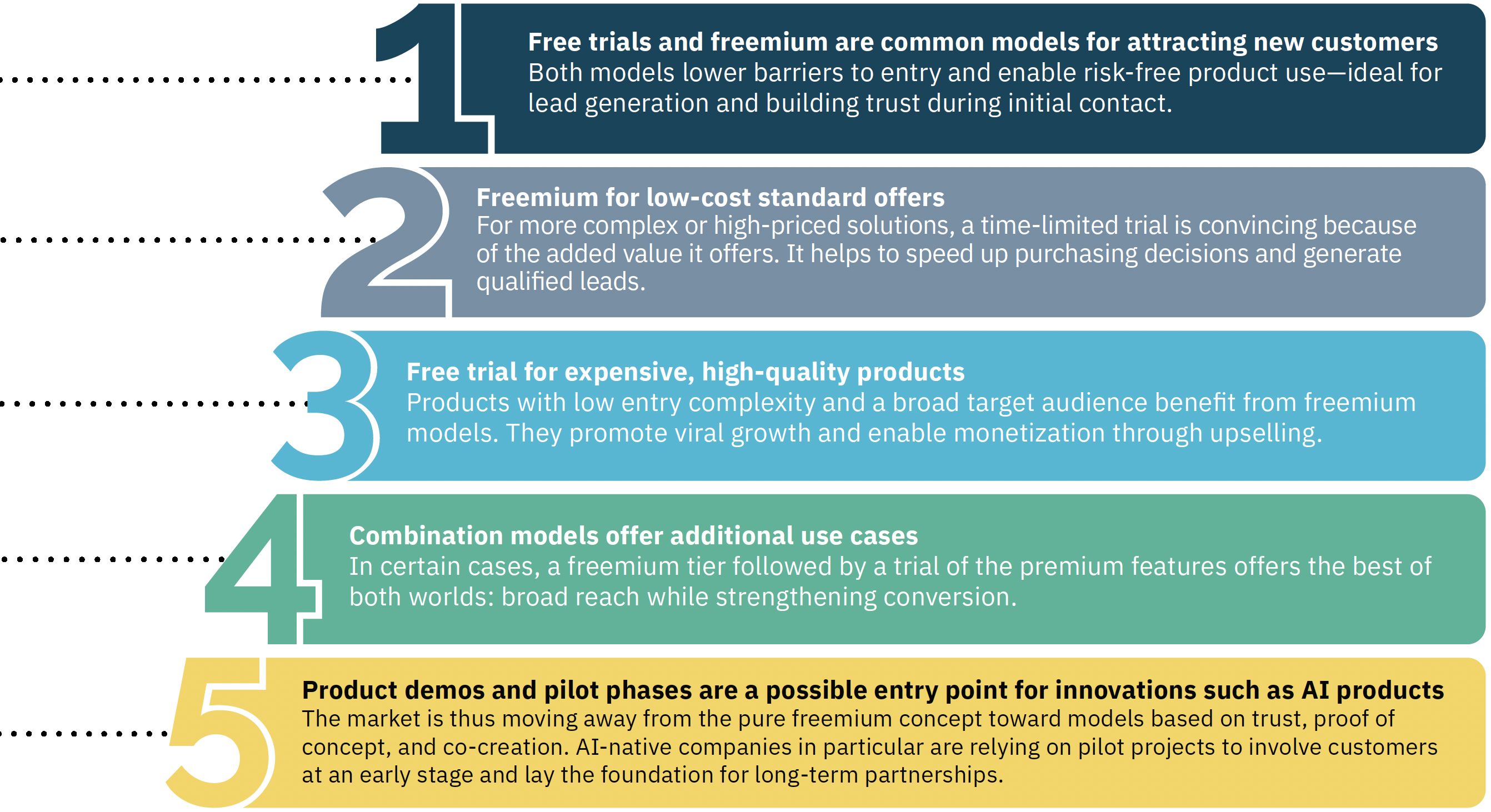

Companies mainly offer free trials or freemium. Reverse trials are rarely used, even though they are a valuable tool for acquiring new customers

The most common form of introductory offer in SaaS is the free trial period. Freemium models are also widespread, as is the combination of both models, which has established itself as a popular tool for acquiring new customers.

However, there are many SaaS companies that deliberately choose not to offer an introductory offer. There are several reasons for this:

- The most common form of introductory offer in SaaS is the free trial period

- Freemium models are also common

- The combination of both entry-level models has also become a popular way of acquiring new customers

- Nevertheless, there are many SaaS companies that do not have an introductory offer

Let’s break it down: When does which new customer model make sense?

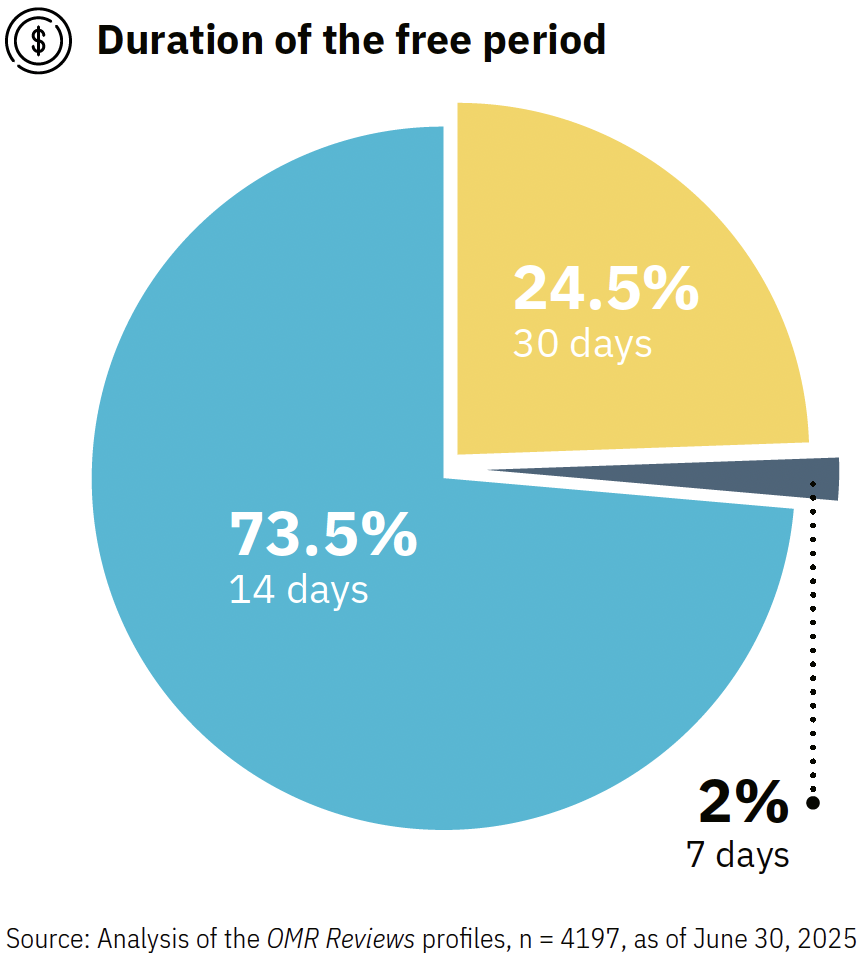

Free trials typically last 14 or 30 days, and freemium models

In the SaaS sector, free trial periods are standard practice when acquiring new customers. Our analysis shows a clear pattern in terms of duration: 14 days is the most common offer, with some providers offering 30 days, while very few offer a short 7-day trial period.

The logic behind this is clear

- 14 days is considered the optimal compromise between rapid conversion and sufficient time to recognize initial added value

- 30 days are mainly used where integration is more complex or trust needs to be built up

- 7 days are rare, as customers can hardly grasp the full benefits in such a short time; more useful for very self-explanatory products

This shows that the market has clearly settled on 14 days as the dominant standard. Longer trials are more suitable for solutions that require explanation, while short trial periods only work in niche models.

The shift from generic software solutions to more personalized tech stacks through agentic AI is also changing how customers are acquired

SaaS companies rely on classic freemium models or free trial periods to attract new users. Free trials in particular are a key lever, as they allow products to be tested in a standardized way.

AI is changing this pattern. These models are only of limited use, especially for highly personalized, complex, or customer-specific use cases. Our expert interviews show that trust and reliability are crucial when it comes to new, highly innovative AI products. A short trial period is not enough to prove added value and stability.

Instead, product demos and pilot phases are coming to the fore. This allows companies to test how an AI system integrates into their processes and what concrete benefits it creates in realistic scenarios. This makes the introduction less superficial and more focused on real use cases.

The market is thus moving away from the pure freemium concept toward models based on trust, proof of concept, and co-creation. AI-native companies in particular rely on pilot projects to involve customers at an early stage and lay the foundation for long-term partnerships.

Top 5 insights into new customer models

So what?

Before I share my final thoughts, let me start with a thank you! Thank you for taking the time to read our first SaaS & AI Pricing Report all the way through. Clearly, your interest in the topic is as strong as ours. Yes, we all use AI tools daily. They simplify processes, save time, and – rumor has it – also played a small role in the creation of this report.

As pricing consultants, one question drives us most: How can AI – whether embedded in SaaS products or deployed as standalone agents – be monetized in a way that truly reflects its real value in pricing? The answer is rarely straightforward. A dominant model has yet to emerge. Subscription? Transactional? Outcome-based? The landscape is shifting, and that is exactly why solid guidance is needed.

I hope this report has provided just that: inspiration, best practices, and food for thought.

Finally, a big thank you to everyone who contributed: our team at hy, our friends at OMR Reviews, and the many founders and CXOs who openly shared their experiences.

If you feel your pricing is not yet where it should be, feel free to reach out at pricing@hy.co or connect with me directly on LinkedIn.

Best regards,

Dr. Sebastian Voigt

Partner & Co-CEO, hy

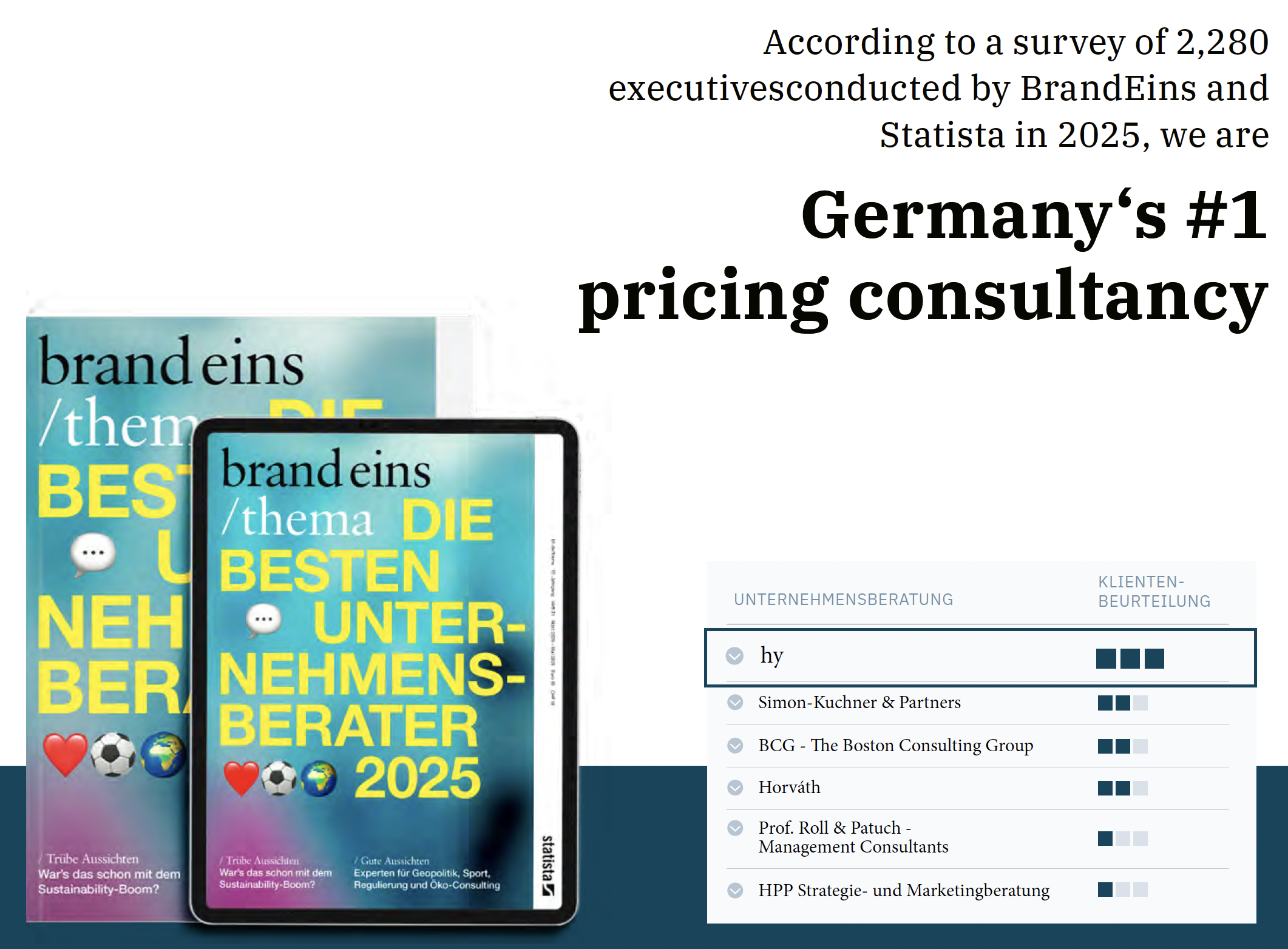

Our focus is pricing for

software and tech companies

May we introduce ourselves:

The Software Information Platform in DACH

OMR Reviews is the leading platform for software reviews and information in the German-speaking market. As part of the wellknown OMR universe – recognized for the OMR Festival in Hamburg with up to 70,000 visitors, or the OMR Podcast, the largest business podcast in DACH – we connect software buyers and vendors.

Our mission is to bring more transparency to the software market. We achieve this with detailed information on more than 10,000 software products, including feature and pricing overviews, and over 70,000 authentic, verified user reviews. These business user experiences are the core of our platform, since genuine user-generated content creates transparency and serves as a critical guide for companies seeking the right software solution.

For software vendors, OMR Reviews is the most effective way to build trust and visibility with their target audience. Our value proposition:

Reach: With top-tier content and strong search engine rankings, we reach software decision-makers at every stage of the buying journey. Our expert articles, software categories, profiles, and thousands of reviews also ensure strong visibility in AI search models such as Google AIO, ChatGPT, and Perplexity. Leverage the massive reach of the OMR brand to boost your visibility strategically.

Trust: Verified user reviews and OMR Reviews awards help you build trust with your target audience. These social proof elements are powerful levers that demonstrably increase conversion rates in your marketing and sales activities.

Performance: We provide valuable buying intent data and qualified leads. Identify which companies are actively searching for solutions in your category, and connect directly with purchaseready prospects through our lead formats.

With us, you secure critical presence at every stage of the decision- making process and seamlessly guide your future customers throughout their entire journey. In short: OMR Reviews is not just a digital directory of B2B software, but your strategic partner to increase reach and awareness, build trust, and accelerate growth in the DACH market.

Feedback? Questions?

Ideas?

Frank Gehrig

Mariella Knospe

Charlotte Pohlmann

Anne Ringbeck

Christoph Röttgen

Dr. Sebastian Voigt

Let‘s talk – we‘re looking forward to hear from you.

sebastian.voigt@hy.co

+49 151 4404 7650

Limitations

The present report provides an insight into the field of SaaS & AI Pricing. The data collected represents only a segment and does not cover the full range of perspectives and topics relevant to this field. The information presented in this report is based on an interpretation of expert interviews, which have been summarized for this report. It should also be noted that hy maintains professional relationships with some of the companies interviewed.

Published in September 2025

Responsible for the content of this report: hy – the Axel Springer Consulting Group

Represented by the Managing Directors Sebastian Herzog and Dr. Sebastian Voigt

Axel-Springer-Str. 65, 10888 Berlin

Editorial Design & Layout: Deborah Amanor • deborah.amanor@gmail.com

Webdesign • Julius Schuler